APPLICABILITY

E-invoicing has been made compulsory by the Government of India for the taxpayers whose annual turnover is above Rs.10 crores with effect from 1st October, 2022 vide Notification No.17/2022. The taxpayers must comply with the provisions of e-invoicing in F.Y. 2022-23 and onwards if their aggregate turnover exceeds the specified limit in any of the financial years from 2017-18 to 2021-22. E-invoicing is applicable only for the B2B invoices.

PROCESS FOR REGISTRATION UNDER E-INVOICING

Step 1: Go to the website https://einvoice1.gst.gov.in/

Step 1: Go to the website https://einvoice1.gst.gov.in/.

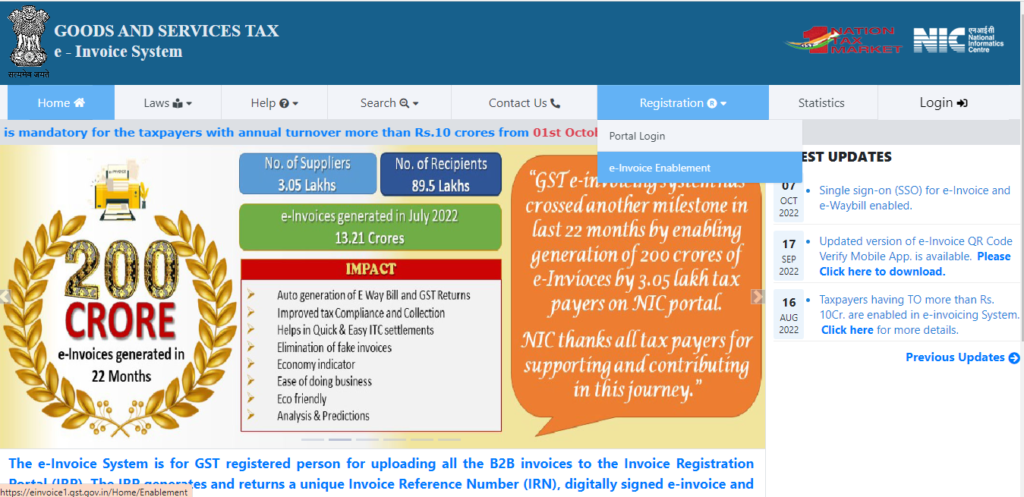

Step 2: Click on “e-invoice enablement” under ‘Registration’ tab.

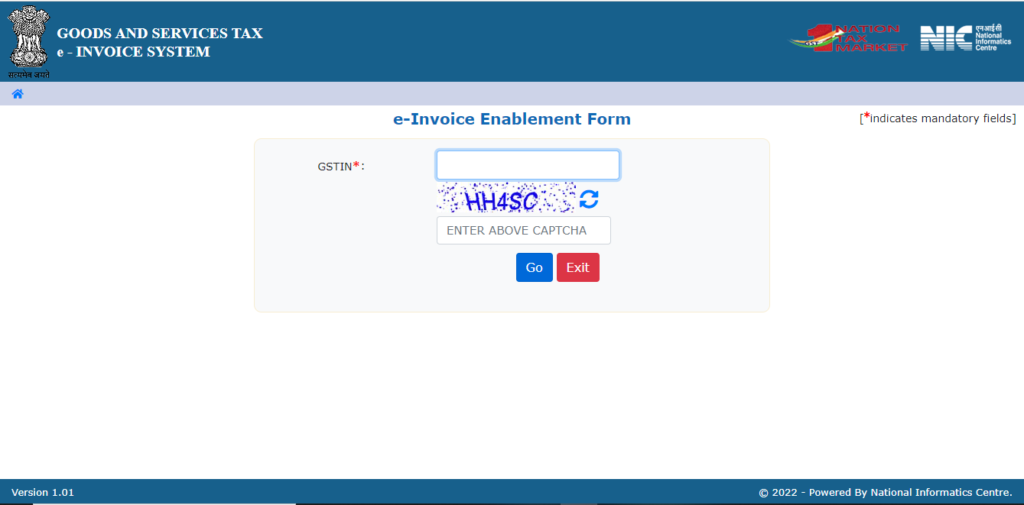

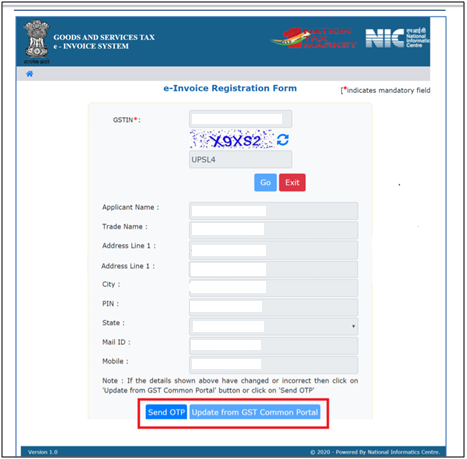

Step 3: Under the enablement form, provide the GST number, enter the captcha, and click on “GO”.

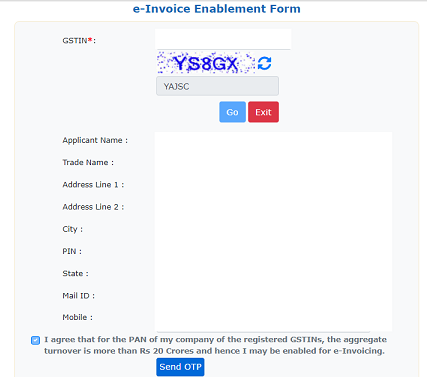

Step 4: Details regarding the Name, Mobile Number, Email Address, etc will appear automatically using the GSTIN. Click on “send OTP” and verify it by providing the OTP sent to the mobile number.

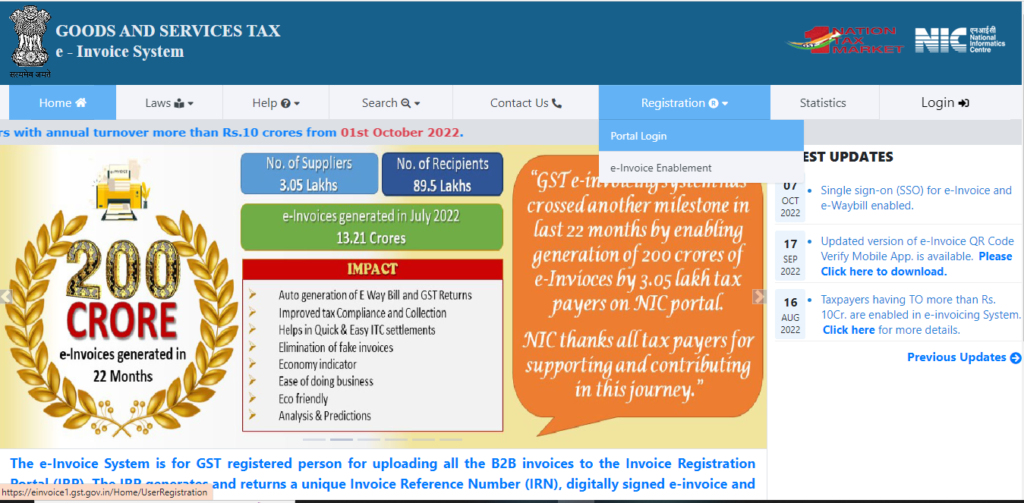

Step 5: After filling out the e-invoice enablement form, go to “e-portal login” under the registration tab.

Step 6: A similar box will appear asking for the GSTIN.

Step 7: After providing the GSTIN and entering the captcha, the following details would be shown.

Step 8: If all the details are not correct, you can click on “Update from GST Portal”, and the details would appear as in the GST Portal. Click on “Send OTP” when all the details are correct. OTP will be sent on the mobile number of the registered party. Verify the same.

Step 9: After verifying the same, the system asks you to set up the log in ID and Password. And after that, you can log in to the e-invoice portal by using the same credentials.

Step 10: As soon as we log in, a dialog box will appear asking for the details (like name, email id, address, designation) of the authorized person.

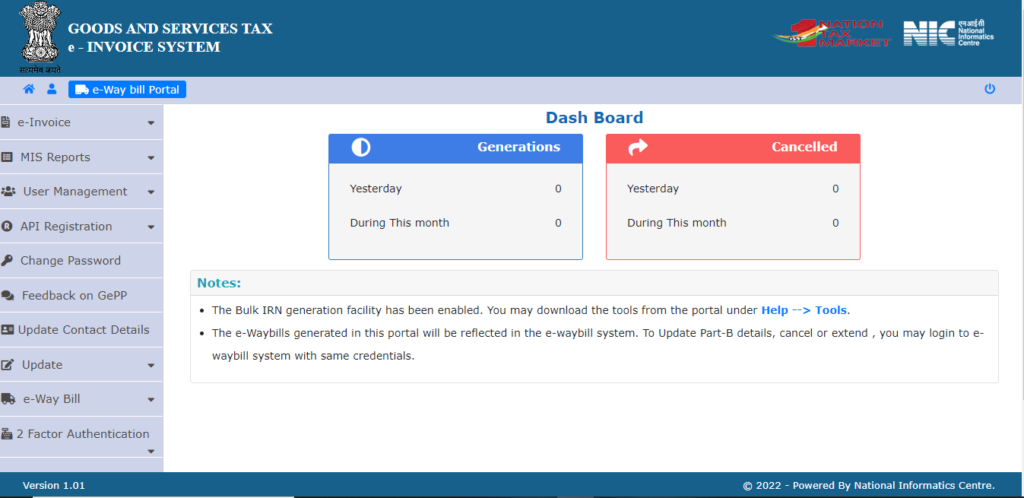

Step 11: Fill in the details and you are ready. Your registration process is complete, and the screen shown below shall appear after logging in. You can create e-invoices and e-way bills here.

HOW TO GENERATE AN E-INVOICE

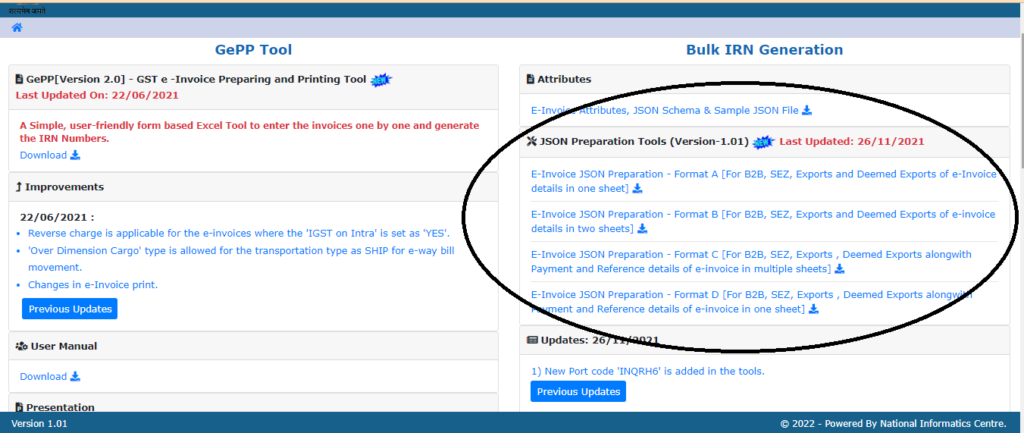

Step 1: On the Home page, Go to Help<Tools<Bulk Generation Tools.

E-Invoice JSON Preparation Utility Template can be seen on the site like above. Format (A,B,C,D) can be chosen according to your requirements.

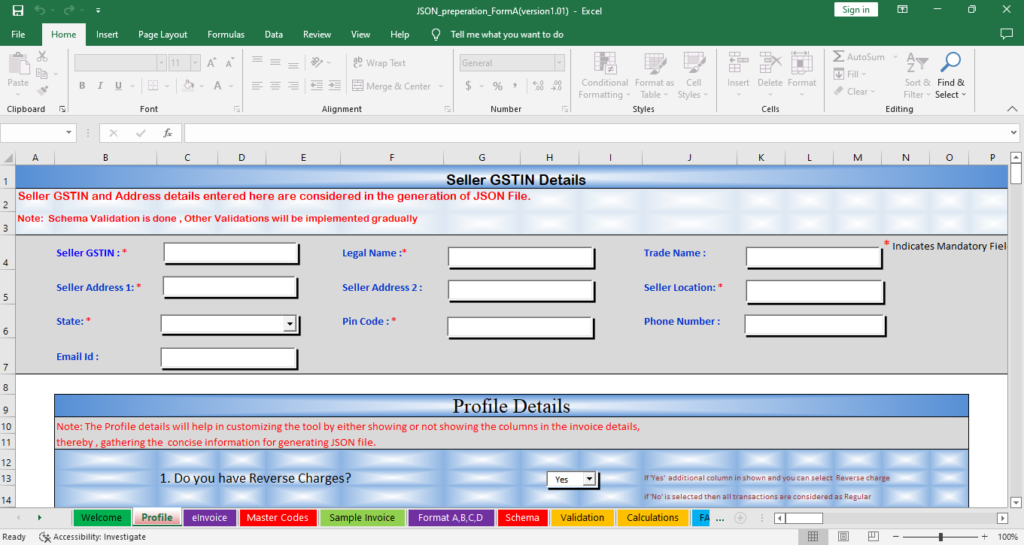

Step 2: The template would be downloaded in Excel Format. Fill in the required details in the Profile tab and the einvoice tab.

In case the file does not open and shows an error for doubtful source, select the file<right click and go to properties<you will get an option to “Unblock” the source under the Security section.

Step 3: After filling all the details in the template, click on “Validate” and then “Prepare JSON”.

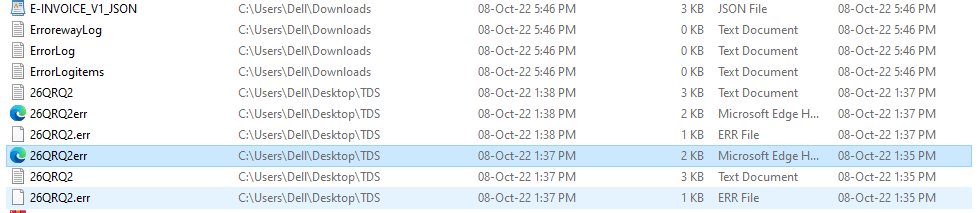

Step 4: In case any error occurs, the file will be created as below.

An html file will be created<Open the file using Google to view the error<Make the correction as required<“Validate and Prepare JSON” file again.

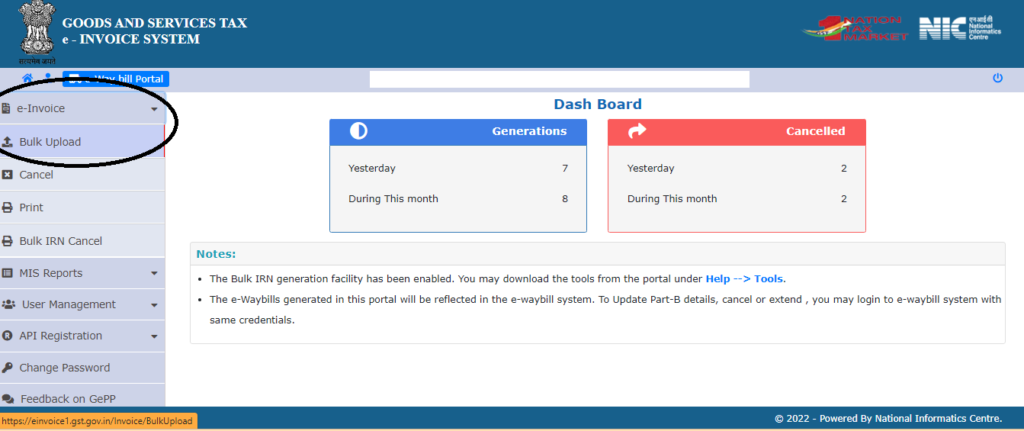

Step 5: Upload the Template file on the einvoice1 portal.

Step 6: Browse the JSON File and upload here. You can view and download the e-invoice thereafter. E-invoice will be downloaded in the format of “zip” file. Unzip the file and E-invoice will be generated in the pdf format.

FAQs

Q1. What is the time limit to generate E-invoice?

Ans. No time limit has been prescribed for the authentication of E-Invoice. However, according to the Rule 48(5), any supplier on whom e-invoicing is applicable, shall issue e-invoice every time. Normal invoice shall not be issued.

Q2. Does the E-invoice need to be signed again?

Ans. According to the proviso to Rule 46 of the CGST Rules, 2017 along with the provisions of Information Technology Act 2000, in case of electronic invoice, a supplier will not be required to sign or digitally sign the invoice.

Q3. Can an e-invoice be modified or cancelled?

Ans. E-invoice cannot be corrected or modified once uploaded. However, the option is provided to cancel the invoice and generate a new e-invoice.

Q4. What is Invoice Reference Number (IRN)?

Ans. IRN is a registration number provided by the government. It is a unique number generated by GSTN which proves the authenticity of the e-invoice after being uploaded.

Q5. Is E-Invoicing applicable for supplies having Reverse Charge?

Ans. Yes, e-invoicing is applicable for the supplies under reverse charge if the turnover exceeds the specified limit.

Q6. Does SEZ Developers also issue e-invoice?

Ans. Yes, even SEZ Developers have to issue e-invoices if the turnover exceeds the specified limit. But SEZ Units are exempt from issuing e-invoices under Notification (Central Tax) 61/2020.