E-INVOICING – APPLICABILITY & REGISTRATION

E-Invoicing is a system for authentication of B2B invoices electronically by the GSTN. Under the electronic invoicing framework, a unique Invoice Reference Number (IRN) is issued against each invoice digitally using Invoice Registration Portal (IRP) managed the GSTN. Maximum 100 items can be incorporated in a single invoice.

E-Invoicing eliminates the need to enter data manually in different portals, i.e., we are not required to enter the same data again and again into GST Portal, E-Way Bill Portal and in the E-Invoice Portal.

E-Invoicing also helps to track the invoices in real-time. It helps in resolving a large gap in data reconciliation under GST to reduce the mismatch of errors. It provides a framework to quickly access the complete invoice related details.

APPLICABILITY

An assessee shall comply with the provisions of e-invoicing if their aggregate turnover exceeds the specified limit in any financial year after the implementation of GST, i.e., 2017-18 onwards. The calculation of aggregate turnover shall include the turnover of all the GSTINs issued under a single PAN across India.

| PHASE | APPLICABLE IF | APPLICABILITY DATE |

| I | TURNOVER > 500 CRORES | 01.10.2020 |

| II | TURNOVER > 100 CRORES | 01.01.2021 |

| III | TURNOVER > 50 CRORES | 01.04.2021 |

| IV | TURNOVER > 20 CRORES | 01.04.2022 |

Example: Suppose PQR Ltd had aggregate turnover as follows:

| YEAR | TURNOVER |

| FY 2017-18 | Rs.12 crore |

| FY 2018-19 | Rs.16 crore |

| FY 2019-20 | Rs.23 crore |

| FY 2020-21 | Rs.18 crore |

| FY 2021-22 | Rs.14 crore |

PQR Ltd shall mandatorily generate e-invoices from 01.04.2022 irrespective of the current year’s aggregate turnover as it has crossed the threshold limit of Rs.20 crore turnover limit in FY 2019-20.

Following class of taxpayers are currently covered under e-invoicing:

- Supplies to the registered persons (B2B)

- Supplies to SEZs

- Exports

- Deemed exports

WHO DOESN’T REQUIRE E-INVOICING?

Following category of a person exempted under e-invoice

- A banking company

- A non-banking financial company

- A financial institution

- An insurer

- A person engaged in supplying passenger transportation service

- A goods transport agency (GTA) supplying services

- A person engaged in supplying services in terms of admission of the exhibition of cinematograph films in the multiplex screen

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR)

- Special Economic Zone units (although e-invoicing is required for SEZ Developers)

HOW TO REGISTER FOR E-INVOICING

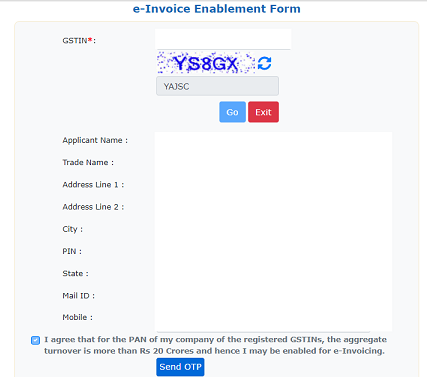

- Go to the website https://einvoice1.gst.gov.in/

- Click on Registration < e-Invoice Establishment.

- Fill your GSTIN, enter the captcha and click on GO.

- After clicking on GO, the details would be shown as below:

- Then, click on SEND OTP. OTP will be sent on your registered mobile number. Verify the OTP.

- Now, select the respective financial year and specify the turnover of that period.

- Click on SUBMIT.

- After submitting the required details, login credentials would be generated. He/she would be registered for preparing e-invoices.

Leave a Reply