CAPITAL GAIN TAX EXEMPTION UNDER SECTION 54 OF IT ACT, 1961

SECTION 54 OF INCOME TAX ACT, 1961

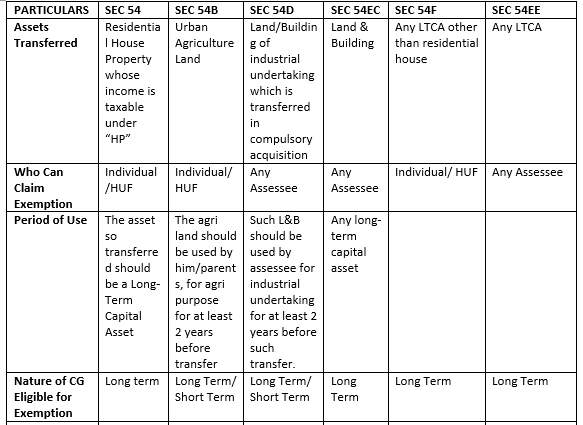

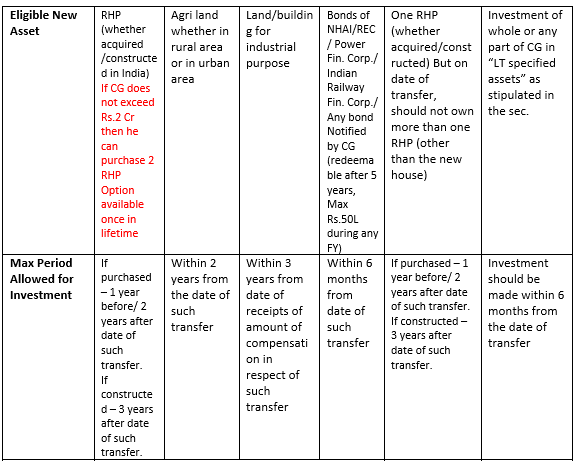

Section 54 gives exemption to a taxpayer who sells his residential house and acquires another residential house property from the sale proceeds. Only an Individual/HUF can avail this benefit under this section.

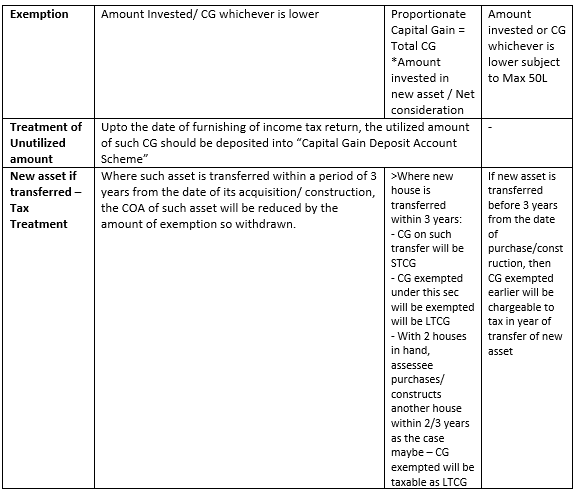

Section 54 provides the exemption which will be the lower of the following:

- Amount of capital gains arising on transfer of residential house;

- Amount invested in purchase/construction of new residential house property including the amount deposited under Capital Gains Deposit Account Scheme.

Exemption is available in respect of only one residential house property purchased/constructed in India. If more than one house is purchased or constructed, then exemption can only be claimed for one house property under this section. No exemption is available in respect of house purchased outside India.

In order to control any misutilization of the exemption claimed under section 54, this section restricts the taxpayer to sell the new house property till 3 years. If the taxpayer sells the new house before 3 years the benefit received under this section will be withdrawn and the amount of capital gain which was earlier claimed as exempt, will be deducted from the cost of acquisition of the new house at the time of computation.

SECTION 54EC OF INCOME TAX ACT, 1961

Section 54EC provides exemption to any assessee for the capital gain arising on sale of land or building, if when the amount received on sale is invested in Specified Bonds. Specified Bonds refer to those bonds issued by the Rural Electrification Corporation, National Highway Authority of India, Power Finance Corporation Limited, Indian Railway Finance Corporation or bonds issued by the Central Government if specified, which are redeemable after 5 years and are issued on or after 01.04.2018.

The Capital gain arising should be invested in a long term specified Asset within 6 months from the date of transfer.

The exemption shall be the lower of:

- Actual Capital Gain; or

- Amount invested in Specified Bonds (less than Rs.50 Lakhs)

However, the maximum investment that can be made under this section is Rs.50 Lakhs

In case bonds are transferred or converted or availed loan or advance against these bonds before the expiry of 5 years, the Capital Gain exempted earlier shall be taxed as LTCG in the year of violation of the condition.

SECTION 54B OF INCOME TAX ACT, 1961

Section 54B provides the benefit of exemption to those Individuals/HUFs who wishes to sell their agricultural land and acquire another agricultural land from the sale proceeds. The old agricultural land acquired shall be used by him or his parents for at least 2 years before the transfer and the maximum period for the new investment to be made in agricultural land is 2 years from the date of such transfer.

Exemption under section 54B shall be lower of:

- Amount of capital gain arising on transfer of agricultural land; or

- Investment in new agricultural land including the amount deposited under Capital Gain Account Scheme.

The exemption shall be withdrawn if the new agricultural land is sold before the period of 3 years from the date of acquisition, and therefore the amount, earlier exempt, will be reduced from the cost of acquisition of agricultural land.

SECTION 54D OF INCOME TAX ACT, 1961

Section 54D gives the benefit to claim exemption to any assessee where capital gain arises on compulsory acquisition of land or building forming a part of industrial undertaking and reinvesting the amount for acquiring new land or building for the purpose of shifting or re-establishing the industrial undertaking.

Exemption under this section is available for both short term and long-term capital gain.

It is mandatory that the transferred asset should have been used for the industrial purpose for a period of at least two years before the date of acquisition. The transferor is required to invest the amount in purchasing any other land or building for the purpose of shifting or re-establishing the industrial units. The said amount needs to be invested within a period of three years from the date of receipt of the compensation

The exemption under section 54D would be lower of:

- Capital Gain on compulsory acquisition of land or building; or

- Amount of investment for acquisition of new land or building

The exemption would be retracted if the new land or building acquired is transferred before 3 years from the date of acquisition and hence, capital gain exempted under this section would be reduced from the cost of acquisition at the time of computation of capital gain.

SECTION 54F OF INCOME TAX ACT, 1961

Section 54F provides the exemption to an Individual/HUF on sale of any long-term capital asset (other than residential house property) and the proceeds shall be reinvested for purchasing or constructing a residential house property. Maximum period for investing in new residential property by purchase is one year before or two years after the date of transfer and by construction is 3 years from the date of transfer.

Exemption under this section shall be available as:

- Full amount of capital gain is exempt in case full consideration is invested.

- Although in case proportionate consideration is invested, exemption will be as

Exemption = Long term capital gain * Amount re-invested / Net consideration

Here, Net consideration refers to the value of consideration excluding any expenditure incurred exclusively for the purpose of transfer.

Exemption would be withdrawn if the taxpayer sells the residential property, whether purchased or constructed, before 3 years from the date of transfer. Exemption under Section 54F will not be available in certain cases:

- If the taxpayer already owns more than one residential house property at the date of transfer of the asset

- If the taxpayer purchases additional residential house (other than the new house purchased/constructed for exemption under Section 54F) within a time frame of one year from the date of transfer.

- If the taxpayer constructs additional residential house (other than the new house constructed/purchased for exemption under Section 54F) within a time frame of three years from the date of such transfer.

SECTION 54EE OF INCOME TAX ACT, 1961

Exemption under section 54EE is available only when the assessee has earned capital gain on the sale of long-term capital gain and reinvested the sale proceeds either partly or in whole in “long term specified assets”. Long Term Specified Assets refers to the unit of funds issued on or after 1st April, 2019 as notified by the Government.

The investment must be made withing 6 months from the date of transfer of such specified asset. And, the total investment in such assets cannot exceed the limit of Rs.50 lakhs during the financial year and even in the subsequent financial year.

Exemption under section 54EE shall be lower of:

- Amount of capital gain arising on the transfer; or

- Rs.50 lakhs.

The amount so invested in the new specified asset cannot be transferred or converted within a period of 3 years. However, if the taxpayer transfer or converts the asset before the lock in period of 3 years, the exemption would be withdrawn and he/she would have to pay long-term capital gain on such transfer.

CAPITAL GAIN DEPOSIT ACCOUNT SCHEME:

To claim exemption under section 54 or under any other subsections as mentioned above, the taxpayer shall accept the conditions according to each section. If the capital gain arising on transfer of the asset is not utilized till the date of filing the return of income, then the benefit of exemption can be availed by depositing the unutilized amount in Capital Gains Deposit Account Scheme in any branch of public sector bank, in accordance with Capital Gains Deposit Accounts Scheme, 1988 (hereafter referred as Capital Gains Account Scheme). The new asset can be acquired by withdrawing the amount from the said account within the specified time-limit as the case may be.

NON UTILIZATION OF AMOUNT DEPOSITED IN CAPITAL GAIN DEPOSIT ACCOUNT SCHEME:

In case the amount deposited under the Capital Gains Account Scheme is not utilized within the specified period for acquisition of the asset, then the unutilized amount (for which exemption is claimed) will be taxed as long- term capital gain of the year in which the specified period gets over.

Leave a Reply