TAX PAYMENT UNDER DRC-03 – APPLICABILITY & PROCEDURE TO PAY ADDITIONAL TAX

DID YOU ALSO RECEIVE ANY NOTICE FROM THE GST DEPARTMENT REGARDING INTEREST ON LATE FILING OF GSTR 3B?

Well if yes, you have your solution right here.

GST Department has been scrutinizing GST returns of preceding years. Any informality or mismatch In GST returns would result in issuing of Show-Cause Notice by the department. Earlier, Late Fee was charged as a penalty for filing late GST returns. But now, GST Department has also started charging Interest for late filing of the returns. Annual Interest of 18% is being charged by the department for late filing. Form DRC can be filed in response to the show-cause notice.

DRC-01 – SUMMARY OF SCN

GST Officer may serve SCN to a registered person due to following reasons:

- Tax not paid/ short paid

- Tax erroneously refunded

- Input tax credit wrongly availed/ utilized.

In case of Bona-fide defaulter: 2 years+ 9 months from due date of filing of Annual return of relevant FY. While in case of Mala-fide defaulter like fraud, suspension, etc. : 4 years+ 6 returns of relevant FY.

DRC- 02 – SUMMARY OF STATEMENT

If GST Officer wants to issue SCN on the same ground as specified in DRC-01, for additional period, than as specified, he may do so by serving the statement under DRC-02.

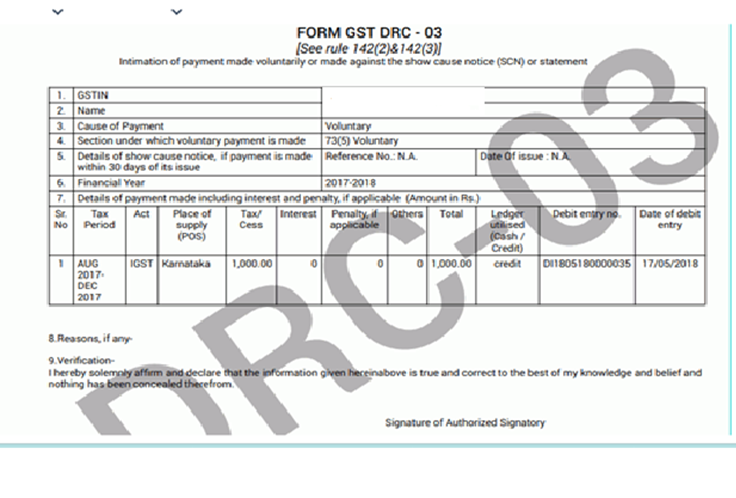

DRC-03 – PAYMENT MADE VOLUTARILY OR MADE AGAINST SCN

DRC-03 is a form under the GST law that is required to be filed for voluntary tax payments towards demand or tax shortfall noticed later on after the time limit to file returns of a financial year expires. DRC-03 is a voluntary tax payment form in which a taxpayer can pay the tax by raising its liability voluntarily or in response to the show-cause notice (SCN) raised by the GST department.

Form DRC-03 is used for making a voluntary payment of tax. Voluntary payment can be made either:

- Before the issuance of show cause notice

- Within 30 days of issue of SCN, in case the show cause notice is already issued

WHEN SHOULD AN ASSESSEE MAKE PAYMENT THROUGH DRC-03?

The following are the causes for making payment under DRC-03:

1. Audit/Reconciliation Statement: Where the auditor has discovered any case of short payment of tax, interest or penalties or excess claim of the input tax credit, and the time limit is expired to report the same in their GST returns, the taxpayer shall make voluntary payment in DRC-03 and report it in GSTR-9. GST Auditor should report the same in GSTR-9C too.

2. Investigation: If during any investigation, it is revealed that the taxpayer had defaulted incorrect payment of taxes, he can voluntarily make payment in DRC-03.

3. Annual Return: Reconciliation of GST for the entire year shall be conducted before proceeding to prepare and file annual returns. Taxpayers are given an option to pay any differences in cash and report it by filing DRC-03.

4. Demand or in response to show cause notice: The taxpayer has an option to pay the tax demanded along with interest using DRC-03 in response to a show-cause notice, but within 30 days of the date of the issue mentioned in the show-cause notice.

Form DRC-03 is filed for making a voluntary payment of outstanding liabilities under Sections 73 and 74 of the CGST Act. A taxpayer can self-ascertain the tax before issuance of SCN or within 30 days of SCN determination to avoid the hassles of demand and recovery provisions.

- Section 73 – deals with cases where there is non-payment/under-payment of tax without any intention or invocation of fraud.

- Section 74 – deals with cases where there is non-payment/under-payment of tax with intention or invocation of fraud

5. Liability Mismatch – GSTR-1 to GSTR-3B: This option was added in the GST portal in February 2021 while selecting the reason for using the DRC-03 form. If the tax authorities have sent notice for differences, being shortfall of tax liability in GSTR-3B when compared to GSTR-1, then the taxpayer must make the payment in DRC-03 or reply by justifying the reasons.

6. ITC Mismatch – GSTR-2A/2B to GSTR-3B: The GST portal also added this as an option in February 2021 for selecting the reason while paying tax in DRC-03. The department can send a notice for claiming excess Input Tax Credit (ITC) in GSTR-3B when compared to GSTR-2B. The taxpayer must use this form while depositing the excess claims of ITC.

Point to note: All the payments need to be made either from input tax credit available in electronic credit ledger or cash balance available in the electronic cash ledger. But, in case of interest and penalties ITC utilization is not available. It has to be compulsorily paid in cash. There is no way to make partial payments against SCN liability.

STEPS TO FILE DRC-03

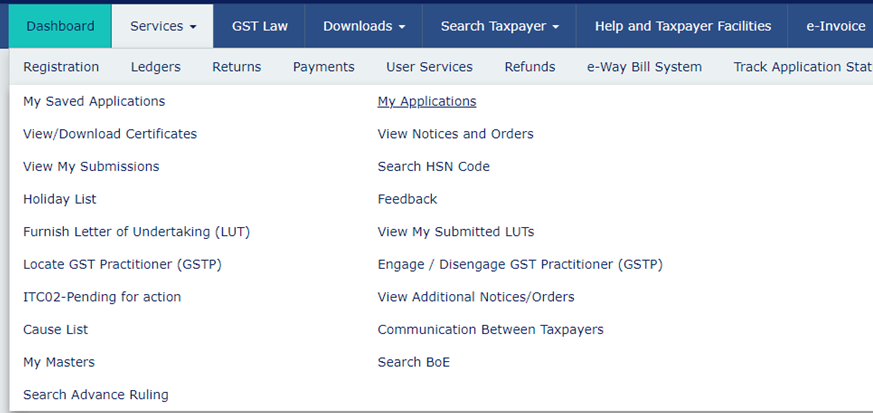

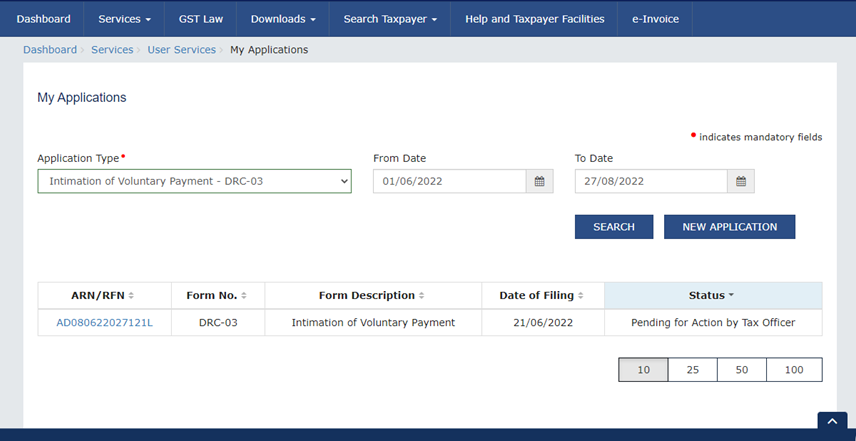

Step 1: Login to GST portal and click on “My Applications” under User Services.

Either of the two circumstances can occur under which a taxpayer makes payment:

- A taxpayer has not made any payment and does not have a Payment Reference Number (PRN)

- A taxpayer has generated PRN but is unutilized and comes for payment.

In Case I where a taxpayer has not made any payment, the following steps are required to be performed.

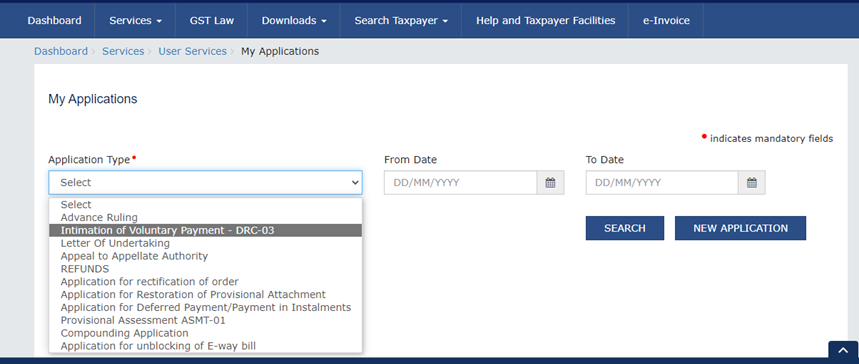

Step 2: Select the Application Type as ‘Intimation of Voluntary Payment – DRC-03’ and then click ‘New Application.’

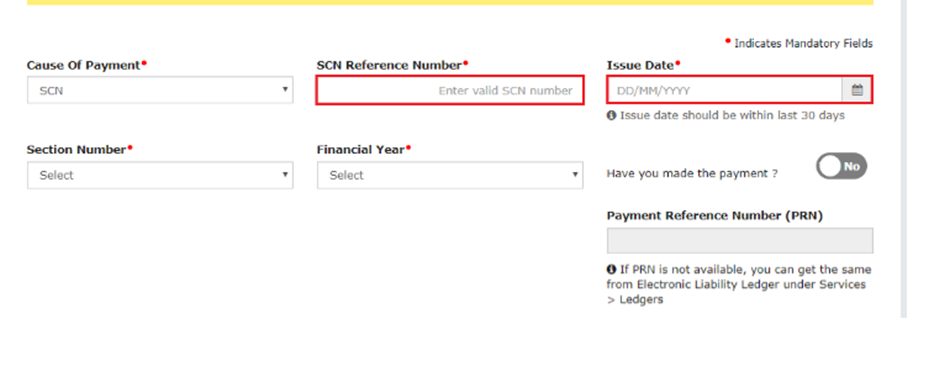

Step 3: A taxpayer will have two options whether payment is made voluntary or against show-cause notice (SCN):

- Voluntary payment: The payment date will be auto-populated without an option to edit.

- Payment against SCN: A taxpayer has to manually enter the SCN Number and select the issue date which must be within 30 days of making payment.

Application for intimation of voluntary payment can be saved at any stage of completion for a maximum time period of 15 days. If the same is not filed within 15 days, the saved draft will be purged from the GST database.

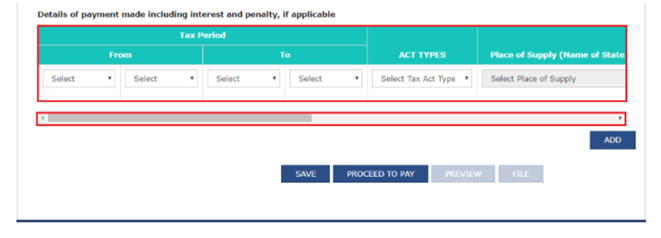

Step 4: Put the SCN Reference Number as the Reference Number generated on the Notice.

- Notice can be viewed under Services> User Services> View Additional Notices/Orders. Rest of the details will be auto-generated by the Reference Number.

- The payment shall be done within 30 days from the date of issue of notice.

Step 5: When all the details are filled, Click on “Proceed to Pay”.

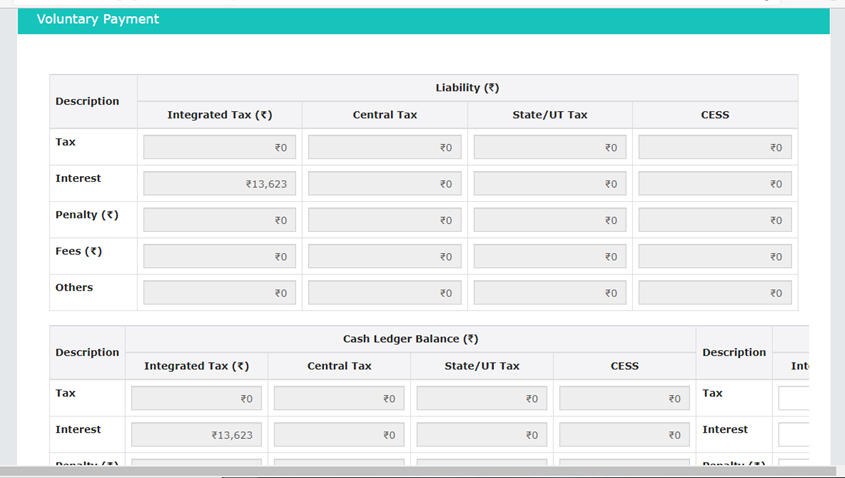

Step 6: A page will appear to generate the Challan specifying the amounts in Electronic Credit Ledger, Electronic Cash ledger and Electronic Liability Ledger.

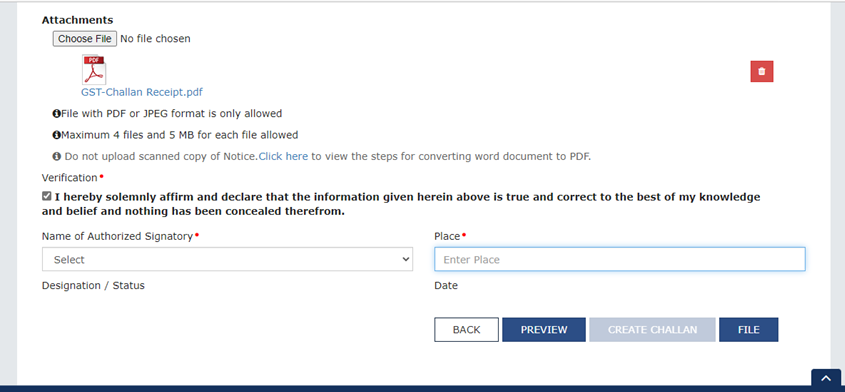

Step 7: Select the name of the ‘Authorized Signatory’ and the Place. Click on “Create Challan” and make the payment.

Step 8: To view your saved application, navigate to Services > User Services > My Saved Applications option.

Click on “File” option. Two options will be available – either to File with EVC or File with DSC.

In Case II where the taxpayer has generated Payment Reference Number (PRN) but is unutilized and comes for payment within the time frame –

Step 1: Follow the steps as mentioned in Case 1 till the taxpayer reaches on Intimation of payment made voluntarily or against the SCN page.

Step 2: Select ‘Yes’ for the option – Have you made payment? and enter the PRN.

If PRN is not available, it can be extracted from the ‘Electronic Liability Register’ under Services>Ledgers>Electronic Liability Register.

Step 3: A link, known as ‘Get payment details’ will be displayed. Once the taxpayer clicks on it, details will be auto-populated on the basis of the respective payment that was made.

Step 4: Click on ‘File’ to view draft DRC-03 and then follow the same steps to file the application as mentioned in Case 1.

WHAT HAPPENS AFTER FILING DRC-03?

After submitting Form DRC-03, Status will be shown as “Pending for Action by Tax Officer”.

DRC -04 – ACKNOWLEDGEMENT

The taxpayer gets an acknowledgement as issued by the tax officer in the form GST DRC-04 (Acknowledgement of Acceptance of voluntary payment). There is no restriction on making another payment on a voluntary basis by a taxpayer, where the acknowledgement by the tax officer is still pending. However, you cannot make a new application while one application is still in the draft.

DRC- 05 – CONCLUSION OF PROCEEDINGS

Once payment has been made, then officer shall use an order in Form DRC-05 specifying about the conclusion of proceedings in respect of such notice.

Leave a Reply