CHARGE ON ASSETS

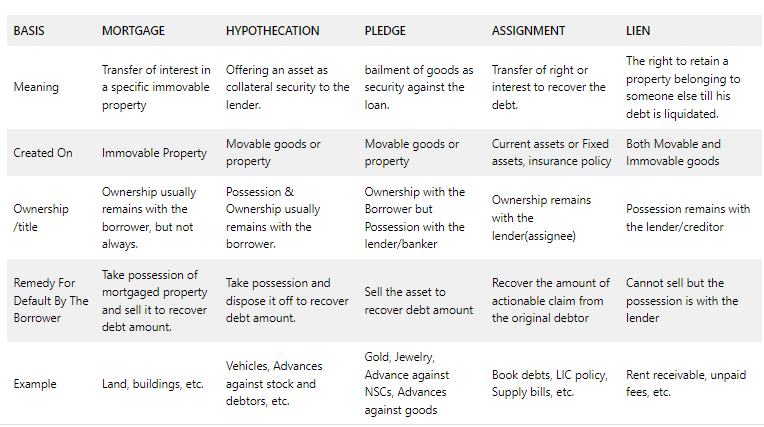

Companies Act, 2013 defines “charge” as an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage. There are various forms of creation of charge. Some of the terms used of creation of charge are: Mortgage, Hypothecation, Pledge, etc. Although these terms are used interchangeably many times, there is different meaning attached to these words. So in this article, you will be able to understand each of the terms separately which are used in the contracts.

MORTGAGE:

A mortgage is one of the ways to create charge against immovable property where the amounts involved are generally very high, and the transfer of title is often passed. Mortgage is the transfer of interest in a specific immovable property in order to secure an existing or future debt.

- The legal ownership of the asset can be transferred to the lender under mortgage if the borrower defaults on the repayment of the loan amount. However, the borrower continues to remain in possession of the property.

- A mortgage is usually used for immovable assets which are permanently fixed to the earth or attached to the land like house, land, building, or any property, etc. Home loans are classified as mortgages.

- The person creating the mortgage is called as Mortgagor while the person in whose favor mortgage is created (usually Banks) is called as Mortgagee.

PLEDGE:

Pledge is the bailment of goods as a security for payment of debt or performance of a promise. Bailment means delivery of goods with some purpose and with the condition that when the purpose is accomplished, the goods will be delivered back to the Bailor. Pledge is a contract between the lender and borrower, where the borrower pledges an asset as a security to the lender. Under Pledge, the ownership of the asset remains with the borrower, however, the possession of the asset is transferred to the Banker/Pledgee.

- Pledge can be charged only on movable goods like stocks. The bank shall take care of the possession in good faith and as the same as its own goods.

- In case of default by the borrower, the bank has a right to sell the goods in his possession with any intervention of the court and recover the amount due.

- If there is any surplus while selling the asset, the amount is returned back to the pledger (borrower).

- The asset can only be sold by the pledgee after giving reasonable reminder and notice to the pledgor(borrower).

- In case of pledge, risk of lending comparatively reduces because possession of assets is with the lender.

- Some examples of pledge are gold /jewelry loans, advance against goods or stock, advances against National Saving Certificates etc.

HYPOTHECATION:

Hypothecation is another way of creating a charge but against movable assets. Hypothecation means offering an asset as collateral security to the lender. The borrower enjoys both the ownership as well as the possession.

- In the case of any default by the borrower, the lender can take the possession of the security and exercise his right to seize the asset and sell the asset to recover the dues.

- The charge created under hypothecation is Equitable Charge (where there is no variation).

- But in case of hypothecation of stocks to the bank, the charge which is created is called floating charge.

- The common example for hypothecation is car loans. In car or vehicle loans, it remains with the borrower but the same is hypothecated to the bank or financer. If the borrower defaults, the bank then takes the possession of the car after providing sufficient notice to recover the money.

- Sometimes when a bank or financial institution puts the already pledged asset as collateral for borrowing from another bank, it is called re-hypothecation.

ASSIGNMENT:

An assignment is another type of charge on current assets or fixed assets. Under assignment, the charge is created on the assets held in the books. Assignment refers to the transfer of right or interest to recover the debt.

- The transferor of the claim is called as the Assignor (Borrower) and the transferee is called the Assignee (Bank).

- Assignor cannot give better title to the assignee than what assignor has.

- In case of default, the assignee, i.e., the bank can recover the amount of actionable claim from the original debtor without reference to the Assignor.

- Assignment is possible through writing only.

- Assignment can be of two types: Legal and Equitable Assignment. Legal Assignment is the agreement where all the legal formalities are done on stamp paper while in case of equitable assignment, all the formalities are written on the paper but the legal element is missing from this.

- Examples of assignments include life insurance policies, books of debts, receivables, etc., which the bank can finance. For example – A bank can finance against the book debts. The borrower assigns the book debts to the bank in such a case.

LIEN:

The right to retain a property belonging to someone else till his debt is liquidated is called as Lien. Under a lien, the lender gets the right to hold up the asset used as collateral against the funds borrowed. However, unless the contract states otherwise, if the borrower defaults on the loan, the lender doesn’t have the right to sell the property.

Example: A piece of cloth is given to a tailor to stitch a suit. After the suit is made, the tailor has the right to retain it as security with him till he is paid the stitching charge by the person who placed the order for the suit. Once the payment is received, the tailor is bound to give the suit to the person concerned.

- It is a right given to the creditor to retain/possess the security until the loan amount is paid. It is the strongest form of security since possession of the security is with the creditor.

- Lien can be on both movable and immovable property.

- But generally, lending companies choose to have mortgages on immovable property and lien on movable security like shares, gold, deposits, etc.

- Examples of lien include rent receivable, unpaid fees, etc.

SET-OFF

A settlement of mutual debt between a creditor and a debtor through offsetting transaction claims is also known as setoff. In order to cover a loan in default, a bank has a legal right to seize funds of a guarantor or the debtor. The right of set-off enables the bank to combine two accounts (a loan account and a deposit account) of the same person. Through this settlement, a creditor can collect a greater amount than they usually could under bankruptcy proceedings. When a setoff clause is entered into, the bank can seize the customer’s current deposit. For purposes of set-off, all bank branches are treated as one single entity. A bank exercising a right of setoff must fulfill the following conditions:

- the account from which the firm transfers funds must be held by the customer owing the firm money;

- the account from which the firm transfers the money and the account from which the money would otherwise have come, must be held with the same firm;

- both the accounts must be held in the same capacity by the customer;

- the debt must be due and payable.

pornailist.com

I want to to thank you for this excellent read!! I certainly loved every bit

of it. I have you saved as a favorite to look at new stuff you post…