SECTION 139(8A) UPDATED RETURN

Budget 2022 has hardened the income tax filing norms for regular taxpayers. Under Union Budget 2022, Nirmala Sitharaman announced that the provision of updated return is available in Section 139(8A) of the Income Tax Act. The taxpayers now have a choice to rectify their income tax return by filing an Updated Income Tax Return. The new provision allows the taxpayers to update their ITRs within two years of filing, on payment of additional taxes, in case of errors or omissions.

The Central Board of Direct Taxes (CBDT) has now notified a new Form ITR-U for documenting updated Income Tax returns in which taxpayers will have to give specific justification for filing it along with the amount of income to be offered to tax. The new Form ITR-U will be available to taxpayers for filing updated income tax returns for 2019-20 and 2020-21 fiscals.

WHO CAN FILE AN UPDATED ITR?

Any person eligible to update returns for FY 2019-20 and subsequent assessment years as per the relevant provisions of the IT Act can file the updated return via Form ITR-U. A taxpayer can file updated return only once for each assessment year.

WHAT DETAILS ARE REQUIRED TO BE MENTIONED IN ITR-U?

In ITR-U, the assessee needs to specify only the amount of additional income, under the prescribed income heads, on which tax is required to be paid. No detailed income break-up needs to be submitted, as in the case of filing regular ITR forms. The taxpayer must also determine the exact reason behind updating the return in ITR-U. Further, it is required to mention the challan details for the additional tax paid for the updated return.

PRESCRIBED DATE TO FILE FORM ITR-U

Form ITR-U can be filed only for the preceding two years of the end of relevant assessment year. The provisions of section 139(8A) have been notified and came into effect from the beginning of financial year 2022-23, hence, in the financial year 2022-23, returns for AY 2020-21 and AY 2021-22 can only be furnished under Updated return.

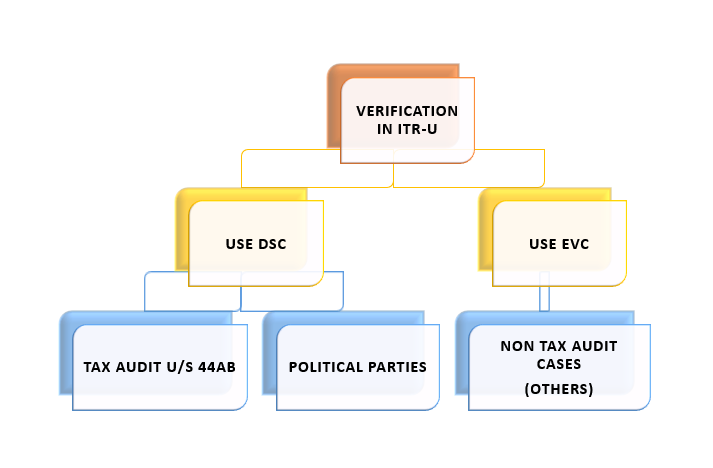

MANNER OF VERIFICATION OF UPDATED RETURN

Updated return shall be verified using Digital Signature Certificate (DSC) in case of political parties and companies who are liable for tax audit under section 44AB.

In other cases, the taxpayers have an option whether they want to file with Electronic Verification Code (EVC) or DSC.

WHAT ARE THE BENEFITS OF FILING UPDATED RETURN?

1) Taxpayer gets an additional time of 24 months to file Income Tax Return even after the due date of filing Original ITR, Belated ITR and Revised ITR have lapsed

2) Taxpayer can report any missed out incomes and pay tax on it thus reducing chances of future tax notices and litigations

3) Tax Liability and penalty under Updated Return is less than in case of proceedings for undisclosed income or income escaping assessment

CASES WHEN AN UPDATED RETURN OF INCOME CANNOT BE FURNISHED

The Form ITR-U cannot be filed in case of following reasons:

- The provision does not allow the taxpayer to file the updated return if there is no additional tax outgo.

- Where a search has been initiated under section 132 or requisition is made under section 132A of the Income-tax Act

- Where a survey has been conducted u/s 133A other than survey u/s 133(2A) of Income-tax Act

- Where any proceeding for assessment or reassessment or re-computation or revision of income is pending under the Income-tax Act

- Where the Assessing Officer has information for Blank Money law, Benami law, etc. in the relevant assessment year.

- Where any information is received under an agreement referred to in sections 90 or 90A of the Income-tax Act

- Where any prosecution proceedings are initiated under the Income-tax Act.

PENALTY ON FILING UPDATED RETURN – PAY ADDITIONAL TAX UNDER SECTION 140B OF INCOME TAX ACT

The taxpayer filing an Updated Return must also submit proof of payment of tax and penalty as per Section 140B of the Income Tax Act.

The provision requires that the taxpayer has to pay an additional 25 per cent interest on the tax due if the updated ITR is filed within 12 months, while interest will go up to 50 per cent if it is filed after 12 months but before 24 months from the end of relevant Assessment Year. Non-payment of additional tax would be considered as invalid, and hence no return would be updated.

Therefore, the taxpayers looking to update their returns for FY 2019-20 will need to pay the tax due and interest along with an additional 50 per cent of such tax and interest. For those looking to file an updated return for FY 2020-21, the additional amount will be 25 per cent of the tax payable and interest.

NOTE: In case the taxpayer has not filed the Original return or Belated return, he/she will have to pay the taxes due for the relevant assessment year along with the late fees as per section 234F. He/she shall also pay the additional tax liability under section 140B of 25%/50% on the taxes due as per the circumstances.

UPDATED ITR U/S 139(8A) V/S REVISED ITR U/S 139(5)?

- A taxpayer can file an Updated ITR even if an original or belated ITR has not been filed. However, the taxpayer cannot file a Revised ITR if an original or belated ITR has not been filed

- The taxpayer can file an Updated ITR only if there is an additional tax liability. In the case of a Revised ITR, there is no such restriction

- The taxpayer need not pay any penalty for filing a Revised ITR. However, the taxpayer must pay a penalty in form of an Additional Tax of 25% to 50% as per Section 140B for filing an Updated ITR

- Updated ITR can be filed only if there is an additional tax liability and not if there is a reduction in tax liability or an increase in the refund or claiming a loss. Revised ITR can be filed for multiple reasons such as claiming a loss, increasing refund, reduction or increase in tax liability, etc.

- The taxpayer can file Revised Return multiple times while he/she can file Updated ITR only once.

Leave a Reply