What is PTEC and How to do PTEC Payment?

About PTEC:

PTEC means Professional Tax Enrollment Certificate. Professional tax is levied by the State Government as a source of revenue and it’s a Direct Tax. PTEC permits to pay the professional tax of the business entity (Private Ltd, Public Ltd, OPC, etc) and also of the owner or professional (sole proprietor, partner, director, etc).

Self-employed persons who carry out Business or Profession on their own and fall in the ambit of profession tax are liable to pay the tax themselves to the state government.

Key States where professional Tax is applicable are Andhra Pradesh, Gujarat, Karnataka, Kerala, Maharashtra, Telangana, West Bengal.

Maximum Amount of Professional Tax – PTEC:

A maximum of Rs. 2,500 can be levied as professional tax- PTEC per financial year.

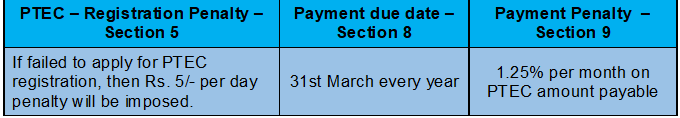

Registration:

As per Section 5 of The Maharashtra State Tax, 1975 every person (other than partnership firms) obtain a PTEC registration is mandatory within 30 days from the date of incorporation or start of the Business / Professional Practice.

New sub section (3A) of section 5 inserted which says “Notwithstanding anything contained in this section, a company, which has been incorporated under the provisions of the Companies Act 2013, after the date of commencement of the Maharashtra State Tax on Professions, Trades, Callings and Employments (Amendment) Act, 2020, shall at the time of its incorporation, obtain the certificate of enrollment and certificate of registration under this Act.”.

Due Date for Payment of PTEC:

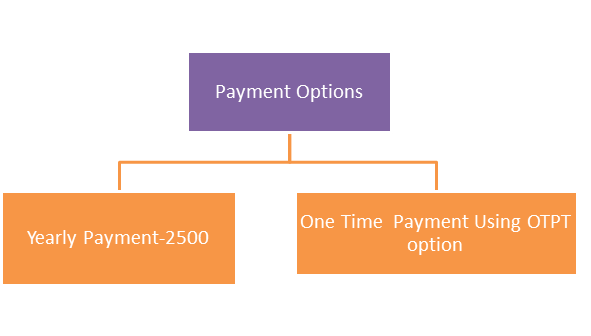

Payment Options:

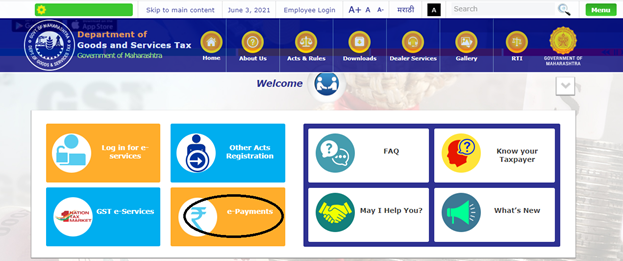

Process of Payment of Tax Online (Rs.2500):

- Go to site https://www.mahagst.gov.in/

- Click on e-payment tab and select the option – e-payment returns as shown below

3) Select e-payment returns

4) Select option PAN and enter PAN & captcha.

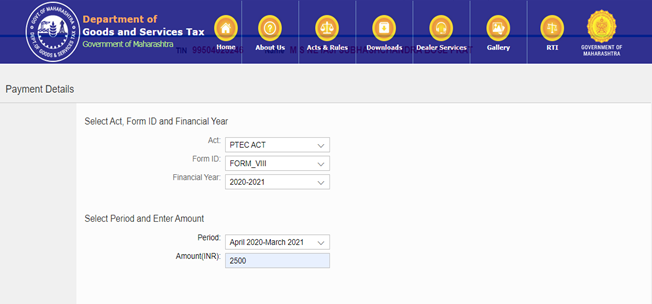

5) Select Act – PTEC Act- as given below

Form ID- FORM_VIII

F.Y- Select F.Y. for which payment pertains.

Amount- INR 2500/-

Location & Mobile No. and then click on proceed

6) Select Option – Agree

7)Then site redirect to payment gateway and do the payment

8) Save the Challan.

Process of Payment of Tax Online (OTPT Option):

- Go to site www.mahagst.gov.in

- Click on e-payment tab and select the option – PTEC OTPT payment as shown below

3) Select – Make a new OTPT payment

And put 11 digits PTEC TIN .

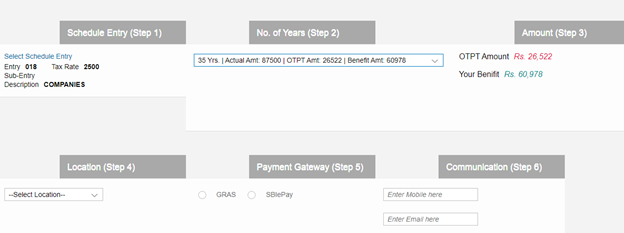

4) Select the correct Schedule Entry.

Select years minimum 3 years and Maximum 35 years.

Location & Mobile No. and then click on proceed.

5) Select Option – Agree

6)Then site redirect to payment gateway and do the payment

7) Save the Challan.

Leave a Reply