Re-Registration Process of Trust U/s 12AB (Last Date is 30th June-2021)

Key points:

The Finance Act, 2020 came with the change in registration process of charitable and religious organizations and also all the existing trusts or institutions registered under section 12A/12AA need to be re-registered themselves under section 12AB. And section 12A &12AA are omitted.

- Section 12A(1) speak about the conditions to be fulfilled by any trust or institution subject to which exemption under sections 11 and 12 shall be available. One of the conditions is that the trusts or institutions are required to registered under section 12AB [Section 12A(1)(ac)].

- The registration process of every trust or institution under the new scheme shall be completely electronic and a 16 digit unique registration number (URN) shall be allotted to each application of Registration or Re-registration.

- The registration validity under section 12AB shall be for 5 years except in the case of provisional registration which shall be valid for 3 years. All registrations made under section 12AB are required to be renewed as specified under new scheme of registration.

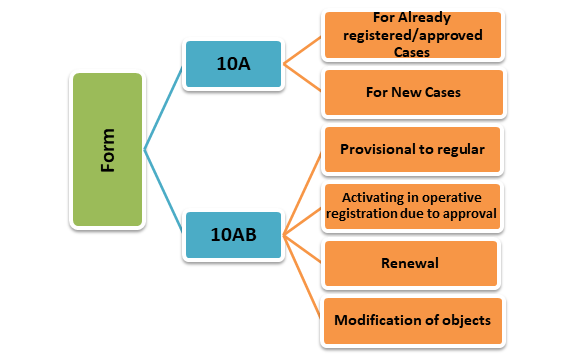

- Initially all the Trust and Institutions those already registered under the previous law “and” Trust and Institutions not registered under the previous law and want to make an application for fresh Registration or Approval under the new law or any other case need to file FORM 10A and the time limit is within 3 months from 1st April, 2021 i.e. up to 30th June, 2021

- Once the Trust and Institutions Registered initially under 12AB with the new law then for re-registration they have to file FORM-10AB and the time limit is at least 6 months before the expiry of the said period.

Registration Process:

Step-1 Visit www.incometaxindiaefiling.gov.in

Step-2 Login with the User ID and password.

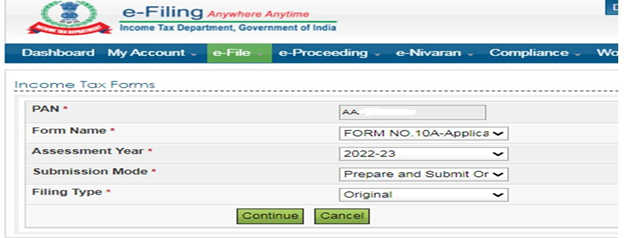

Step-3 Go to e-file>Income Tax Forms.

Step-4 Select ‘Form 10A’ from the dropdown menu of ‘Form Name’ and click ‘Continue’.(Form 10AB is not available yet)

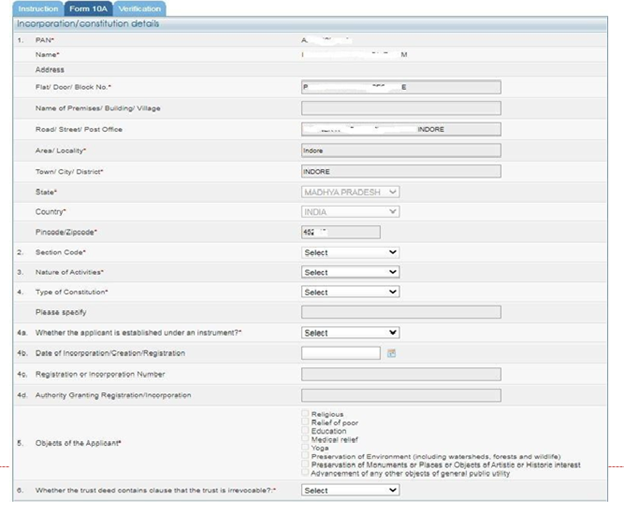

Step-5 On the landing page, you will find 3 tabs:

- Instructions: This tab has general instructions for the applicant to fill the details in Form 10A. It is advisable to read the instructions carefully before filling the form.

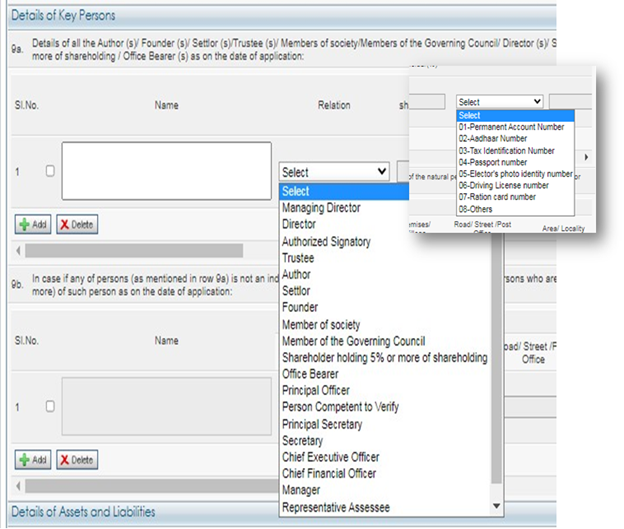

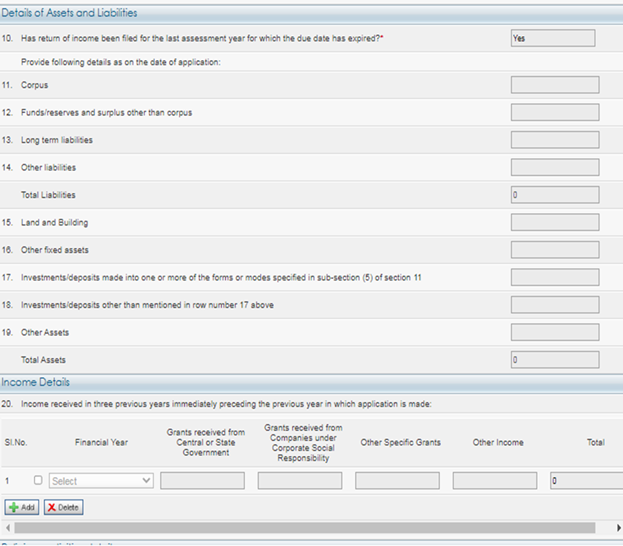

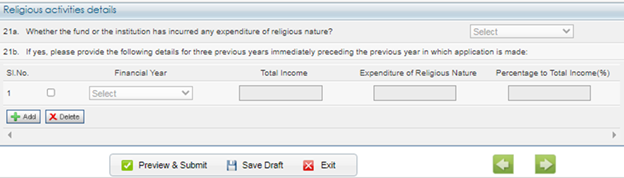

- Form 10A: Fill the required information in Form 10A.

- Verification: Fill the details in verification tab.

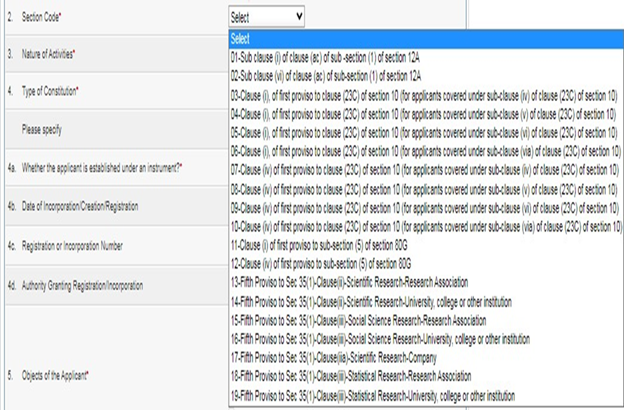

Step-6– Type of Constitution :Trust, Society, Company, Others.

Nature of Activities : Charitable Religious Religious cum Charitable.

Step-7– Once all data filled, Submit the form with DSC or EVC.

AntonioSek

Thus, all existing trusts or institutions which are registered under Section 12A or Section 12AA will have to mandatorily be required to apply for re-registration within a period of three months starting from 1st April, 2021 i.e. The corollary of not complying with this requirement by existing trusts or institutions could potentially result in burdensome tax implications for such trusts or institutions under section 115TD. We congratulate and applaud the good intentions of the Government in leveraging on the benefits of technological advancements by bringing a uniformity in the process of registration in online mode and also to iron out the creases that are there in the existing registration process which is manual and is scattered all over the Country.