Input Service Distributor (ISD) under GST Law

What is Input Service Distributor under GST Law?

A supplier of goods /services may have various offices such as head office (registered office), regional office, branch office, sales depot etc., Such units having large share of common expenditure (input services) but get invoiced on centralized location may obtain registration as an Input Service Distributor for availment of credit on such input services and distribution of credit to other units and strengthen the seamless flow of credit under GST.

Key points from Definition of ISD under section 2(61) of CGST Act:

- ISD mechanism is meant only for distribution of the credit on common invoices pertaining to input “only for services and not goods” (inputs or capital goods).

- The ISD distributes credit of to a supplier of goods/services having office in different locations but registered under same PAN.

- An ISD will have to take a separate registration as such ISD compulsorily.

- No threshold limit for registration for an ISD.

- ISD issues tax invoice or other prescribed documents for distribution of credit.

- The concept of ISD under GST is carried over from the Service Tax Regime.

Example:

The head office of M/s XYZ Limited is located in Mumbai having branches in Chennai, Bangalore and Kolkata. The head office incurred Business promotion expense (service) for beneficial for company as a whole and received the invoice for the same. Since the advantage of promotion is benefiter to all its branches, the input tax credit of entire services cannot be claimed in Mumbai. The same has to be distributed to all the locations. In this case the head office at Mumbai is the Input Service Distributor (ISD).

How to credit distributed by ISD?

As per Section 20 (1)of CGST Act 2017, states that the Input Tax Service Distributor (ISD) shall distribute the credit (ITC) of CGST as CGST or IGST and IGST as IGST, by issue of a document containing the amount of Input Tax Credit (ITC) being distributed in such manner as may be prescribed in rule 54(1) of the CGST Rules, 2017, and it is clearly mentioned that such invoice that it is issued only for distribution of input tax credit.

| Credit of | Distributed As (if Recipient in same State) | Distributed As (if Recipient in different State) |

| CGST | CGST | IGST |

| IGST | CGST or SGST | IGST |

| SGST | SGST | IGST |

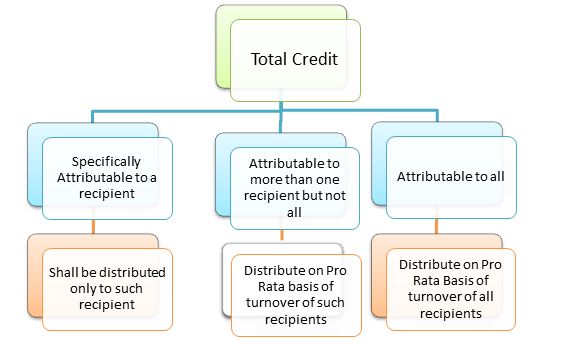

The credit has to be distributed only to the branch/unit to which the supply is directly attributable. If input services are attributable to more than one recipient of credit, the distribution shall be in the “Pro-rata basis of turnover” during the Relevant Period.

Aggregate of the turnover of all such recipients to whom such input service is attributable and which are operational in the current year.

Meaning of “Relevant Period”

(a) If the recipients of the credit have turnover in their State in the preceding financial year during which credit is to be distributed, the said financial year, or

(b) If some or all recipients of the credit do not have any turnover in their State in the preceding financial year during which the credit is to be distributed, the last quarter for which details of such turnover of all the recipients are available, previous to the month during which credit is to be distributed.

Key points from Distribution process:

- For the purposes of distributing the input tax credit, an ISD has to issue an invoice/relevant document, as prescribed in rule 54(1) of the CGST Rules, 2017, clearly indicating in such invoice that it is issued only for distribution of input tax credit.

- The input tax credit available for distribution in a month shall be distributed in the same month and details for the same should be furnished in FORM GSTR-6 (Monthly Return)

- An ISD shall separately distribute both the amount of eligible and ineligible input tax credit.

- An ISD cannot accept any invoices on which tax is to be discharged under reverse charge mechanism. If ISD wants to take reverse charge supplies, then in that case ISD has to separately register as Normal taxpayer.

- The amount of the credit distributed shall not exceed the amount of credit available.

- Excess credit distributed can be recovered along with interest only from the recipient and not from ISD. The provisions of section 73 or 74 would be applicable for the recovery of credit.

Leave a Reply