Form 10-IEA is required to fill by individuals or HUFs those want to continue with the old tax regime in the present financial year ie FY 2023-24. The Budget 2023 proposes that from FY 2023-24, the new tax regime will be considered the default tax regime. By filling Form 10-IEA, taxpayers can choose the old tax regime. They must file the form on or before the due date prescribed for filing an income tax return. Let’s start with the detailed analysis of Form 10-IEA and go through its important aspects.

What is Form 10-IEA

In FY 2022-23 the old tax regime was announced as the default tax regime. Those taxpayers willing to choose the New tax regime must have to file Form 10-IE electronically. But in FY 2023-24 the new tax regime was announced as the default tax regime. And now those taxpayers willing to choose the New tax regime must have to file Form 10-IEA electronically and this action make Form 10-IE which was earlier employed to opt for the new tax regime has now been discontinued

Purpose of Filing Form 10-IEA

let’s understand the purpose of Form 10IEA.

- Individuals and HUF’s having income from profession/business must file Form 10-IEA by adhering to the prescribed deadline under Section 139(1). Please note this revised procedure streamlines the process, enabling individuals without business or professional income to directly specify their preference while filing a tax return by selecting the preferred option.

- The corresponding choice determines the rules and regulations that would be applicable to the assessee.

- Filling Form 10-IEA requires individuals to provide all the necessary information like PAN number, assessment year, name, and current status. These details can be used to accurately categorise and identify taxpayer information.

How to File Form 10-IEA

Follow these steps for filing Form 10-IEA online:

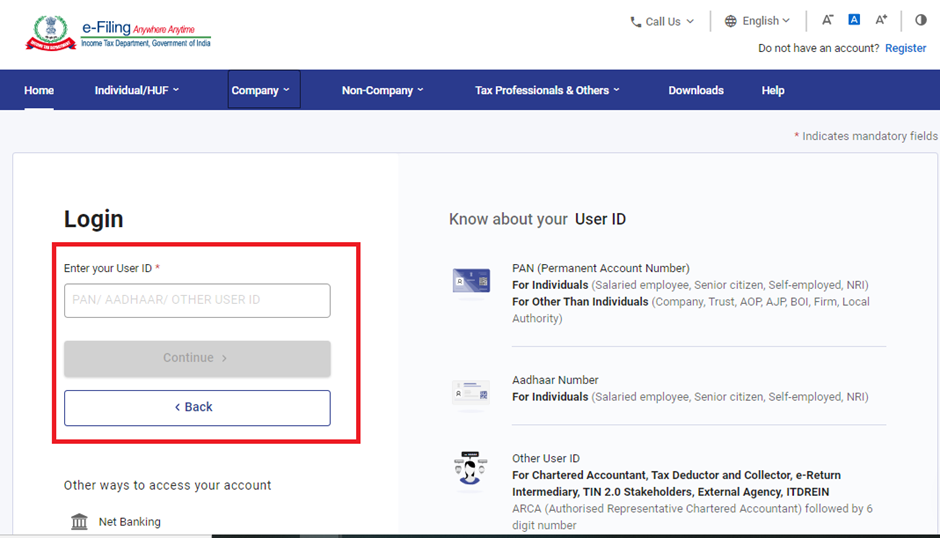

Step 1: Login on the e-filing portal

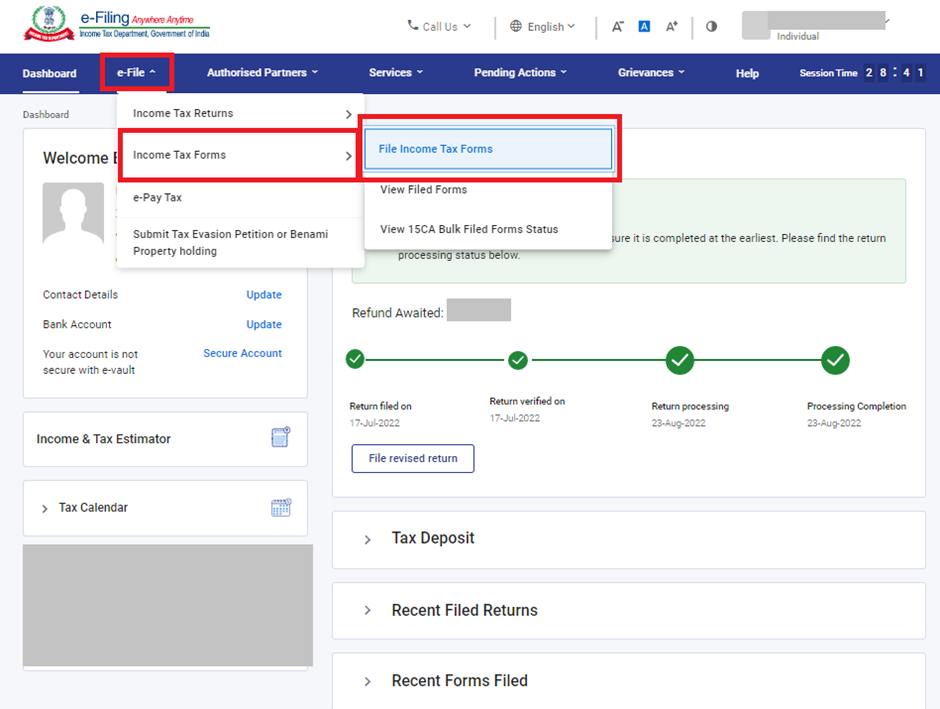

Step 2: On the dashboard, click ‘e-File’ > ‘Income tax forms’ > ‘File Income Tax Forms’

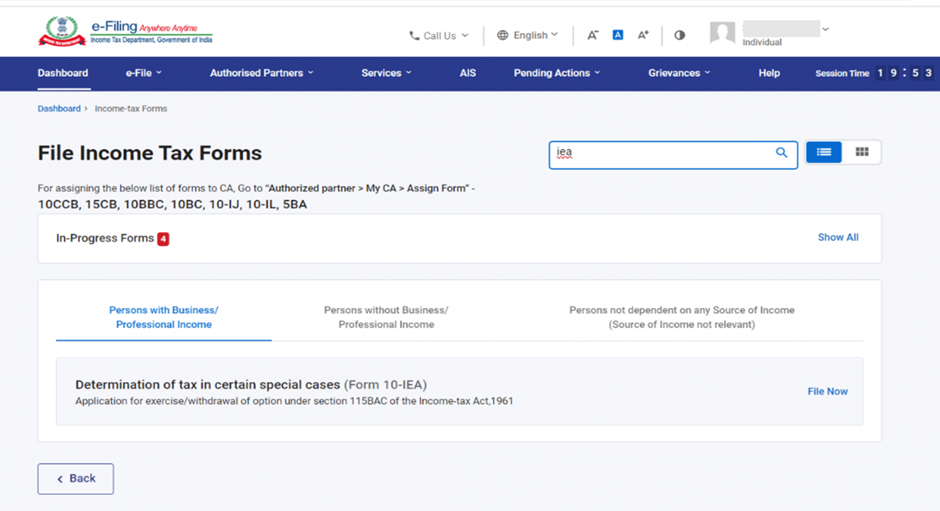

Step 3: Scroll down to select Form 10-IEA. Alternatively, enter Form 10-IEA in the search box. Click on ‘File now’ button to proceed.

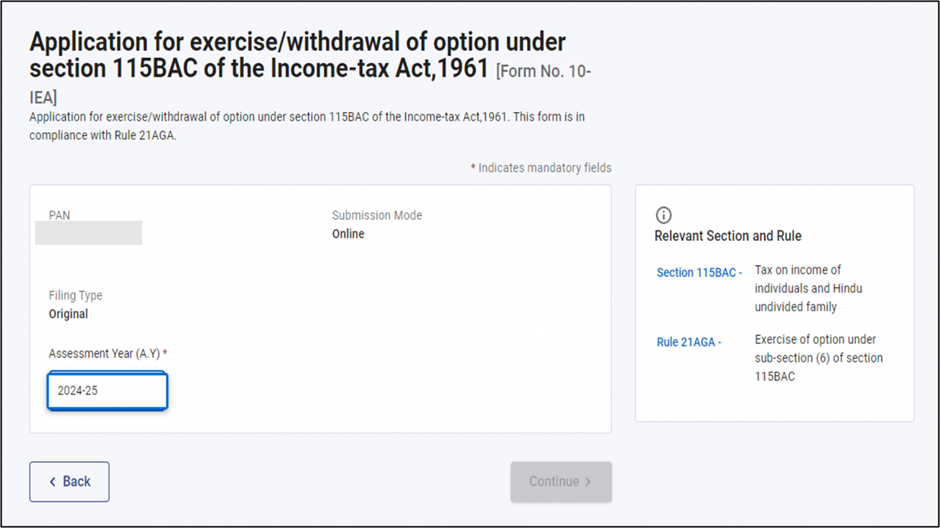

Step 4: Select the Assessment Year for which you are filing the return. For eg: If you are filing taxes for the income earned in FY 2023-24, then select AY 2024-25.

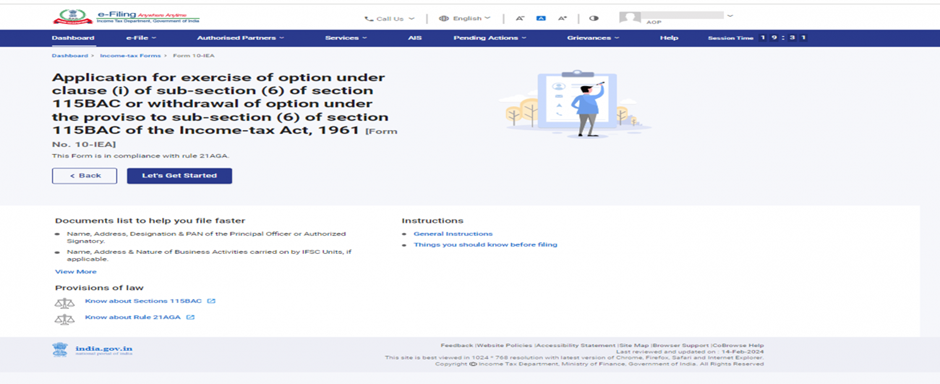

Step 5: After checking the documents required for filing the form click on ‘Let’s Get Started’.

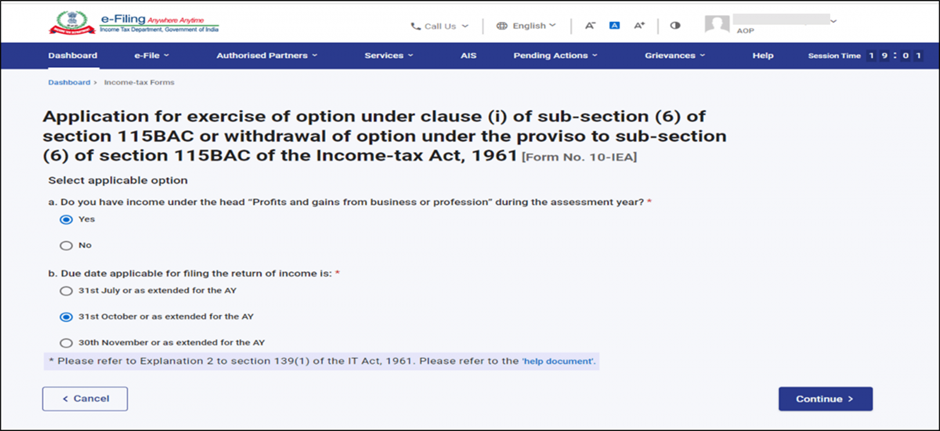

Step 6: Select “Yes” if you have Income under the head “Profits and gains from business or profession” during the assessment year. Select the due date applicable for filing of return of income and click on continue.

Note: Use “help document” by clicking on help document hyperlink for the help for selecting the applicable due date.

Step 7: Click ‘Yes’ to confirm the selection of the regime.

Step 8: Form 10-IEA has 3 sections. Verify and Confirm each section. They are as follows:

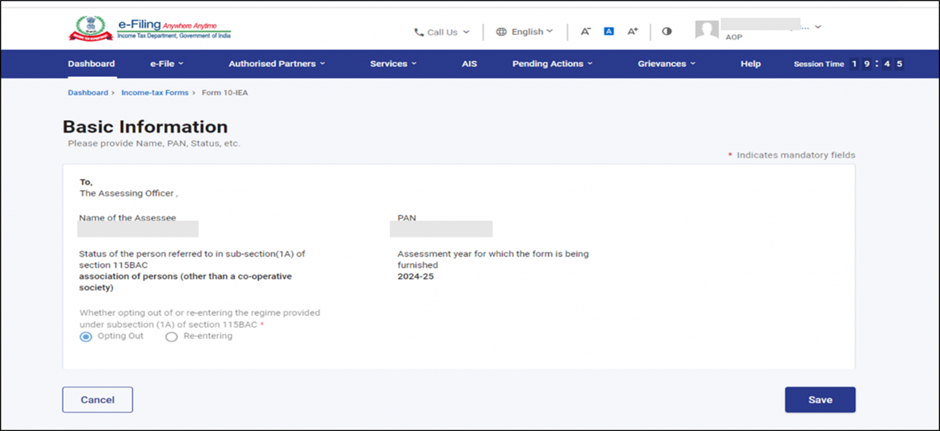

i. Basic Information: In Basic Information section, your basic information will be pre-filled. If you are filing form for the first time then opting out option will be auto-selected and if system has valid form with opting out option, then re-entering option will be auto-selected. Click on ‘Save’ button.

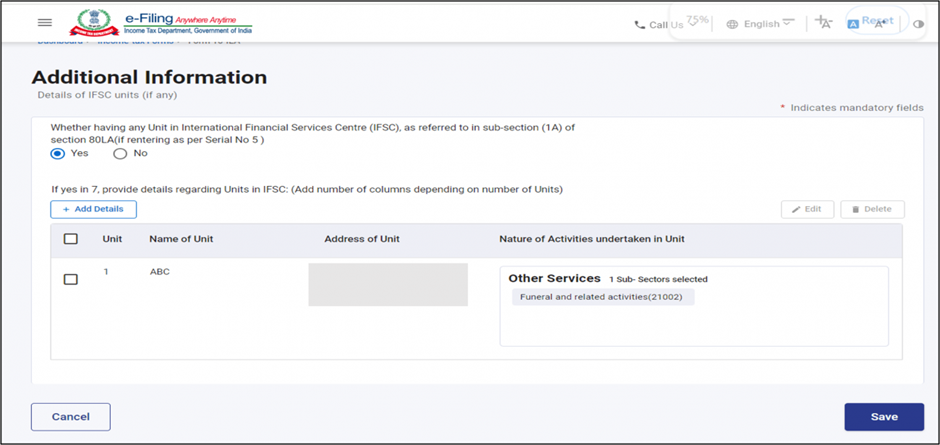

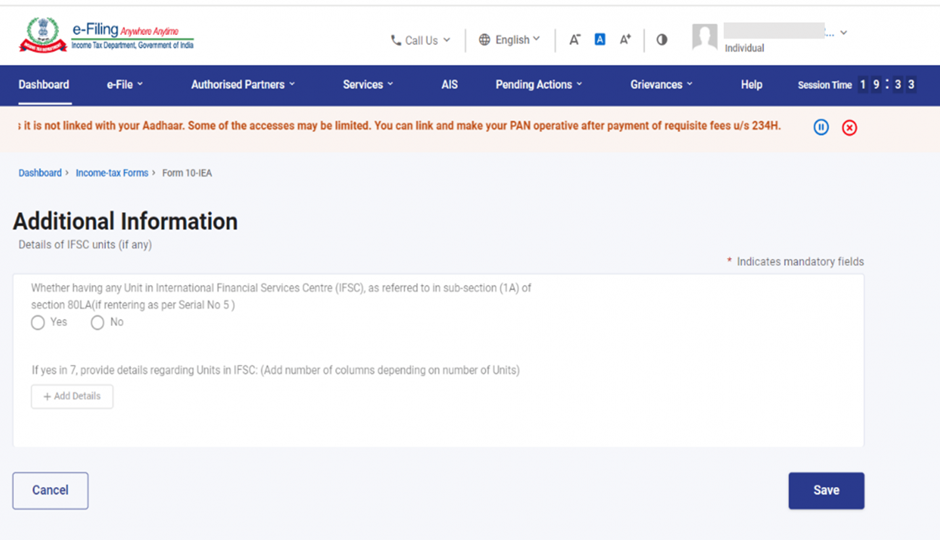

ii. Additional Information: Fill the necessary details in Additional information section related to IFSC unit (if any) and click on ‘Save’.

If you are opting out of new Tax regime this Additional Information panel will be greyed off

iii. Declaration and Verification: Verification section contains self-declaration where you will be required to check the boxes and agree to the terms and conditions. Verify whether all the details are correct and save the information. Once done, click on ‘Preview’ to review Form 10-IEA.

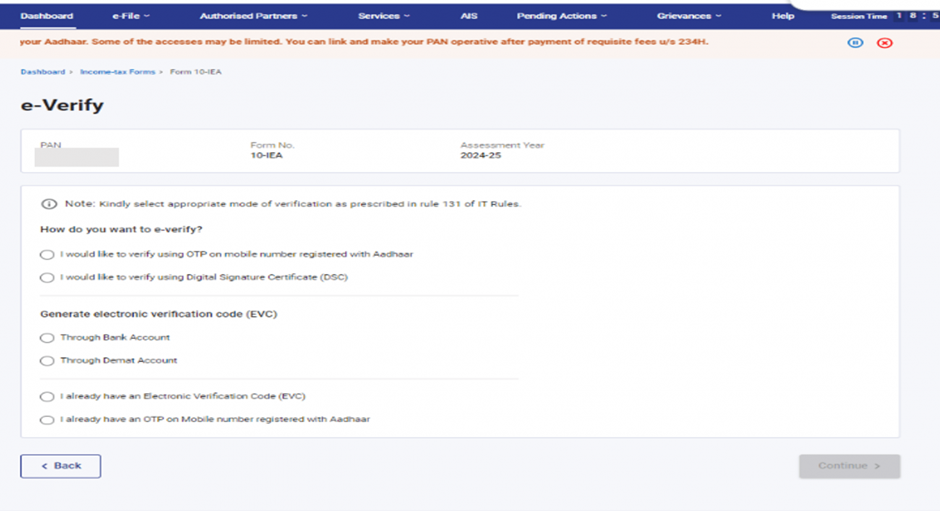

Step 9: After reviewing all the information, ‘Proceed’ to e-verify’. You can e-verify either through:

- Aadhaar OTP

- Digital Signature Certificate (DSC)

- Electronic Verification Code (EVC)

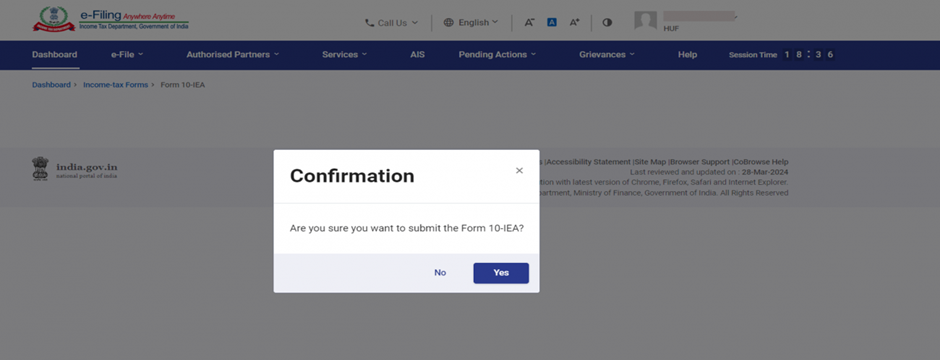

Step 10: After verification Click on ‘Yes’ to submit the Form.

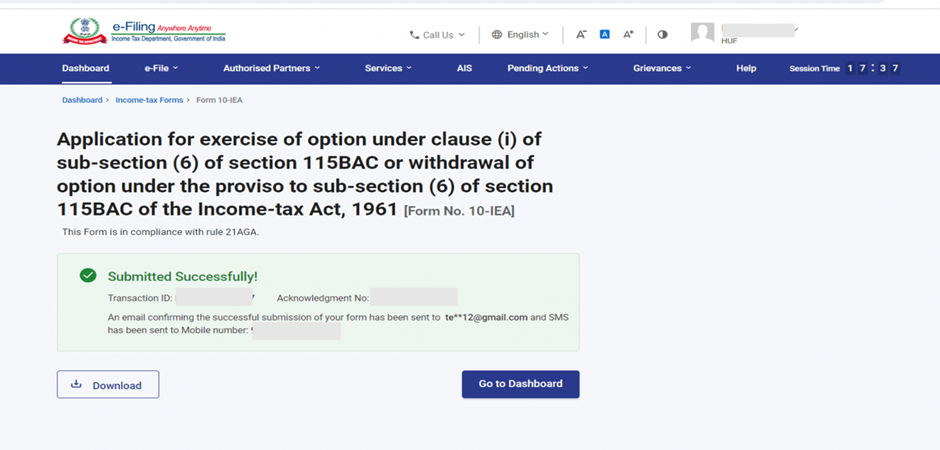

Step 11: After successful e-Verification, a success message is displayed along with a Transaction ID and an Acknowledgement Receipt Number. Please keep a note of the Transaction ID and Acknowledgement number for future reference. You can also download the form and locate the acknowledgment number.

To download the filed form, go to ‘e-File’ → ‘Income Tax Forms’ → ‘View Filed Forms’.