WHAT IS A BUSINESS TRUST?

Section 2(13A) of Income Tax Act defines Business Trust as below: “Business trust” means a trust registered as, —

(i) an Infrastructure Investment Trust under the Securities and Exchange Board of India (Infrastructure Investment Trusts) Regulations, 2014 made under the Securities and Exchange Board of India Act, 1992 (15 of 1992); or

(ii) a Real Estate Investment Trust under the Securities and Exchange Board of India (Real Estate Investment Trusts) Regulations, 2014 made under the Securities and Exchange Board of India Act, 1992 (15 of 1992)

Business Trust act like a mutual fund that invest into real estate projects or infrastructure projects by raising resources from different investors. These trusts can raise capital by way of issue of units which are listed on a recognized stock exchange. Business trusts can also raise debt from people – both residents and non-residents. It is not necessary that the business trust must be listed, however it is mandatory for it to be registered with SEBI with effect from 1st April, 2020.

REAL ESTATE INVESTMENT TRUST (REITs)

REITs are companies which owns, manages and finance few income-generating real estate and offers its units to public investors. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and even timberlands.

Globally, REITs invest primarily in completed, revenue generating real estate assets and distribute major part of the earning among their investors. Typically, most of such investments are in completed properties which provide regular income to the investors from the rentals received from such properties.

REITs are principally expected to invest in completed assets. Income would consist of rental income, interest income or capital gains arising from sale of real assets / shares of SPV. They are managed by professional managers which usually have diverse skill bases in property development, redevelopment, acquisitions, leasing and management etc. Listed REITs provide liquidity and therefore provide easy exit to the investors.

INFRASTRUCTURE INVESTMENT TRUSTS (InvITs)

Infrastructure Investment Trusts make direct investment in infrastructure facilities which are yielding income e.g., Toll Road, Railways, Inland waterways, Airport, Urban public transport. InvITs will allow infrastructure developers to monetize specific assets, helping them use proceeds for completing projects of theirs stalled for want of funds.

Structure of InvITs is quite similar to REITs. The main difference is InvITs make investment into infrastructure facilities whereas REITs make investment in commercial real estate properties.

TAXABILITY UNDER SECTION 115 UA:

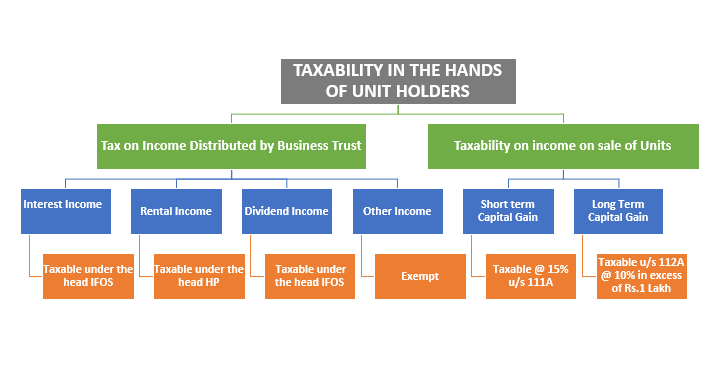

- IN THE HANDS OF THE UNIT HOLDERS:

The income of unit holders of Business Trust can be categorized into two parts.

Tax on Income Distributed by Business Trust:

There is a special taxation regime for taxability of income distributed by such business trusts in the hands of the unit holders. The income distributed by a business trust to its unit holders shall be deemed to be of the same nature and in the same proportion in the hands of the unit holders, as it had been received by, or accrued to the business trust. The person distributing the income on behalf of the business trust is required to furnish the statement of income distributed to the unitholder in Form No. 64B by the 30th June. Example Mr. Saurabh, a resident individual, has received the following ‘Form 64B – Statement of income distributed by a business trust to the unit holders’ for the Financial Year 2017-18.

| S. No. | Amount Distributed | Date of Distribution | Amount of income in the nature of interest referred to in Section 10 (23FC) | Amount of Income in the nature of renting or leasing referred to in Section 10(23FCA) | Amount of Income in the nature of Dividend | Amount of Other Income |

| 1 | 50,000 | 25/10/2020 | 30,000 | 20,000 | ||

| 2 | 75,000 | 16/11/2020 | 25,000 | 27,000 | 23,000 |

Let’s see how taxability of each of such income will be determined in the hands of Mr. Saurabh

- Income in the nature of Interest: The income in the nature of interest referred to in sub clause (a) of Section 10(23FC) is chargeable to tax in the hands of the unit holders. If the unit holder is non-resident the rate of tax on such income is 5% and for resident unit holders, it is chargeable to tax at slab rates. This income is exempt in the hands of the business trust. This interest received or receivable from a special purpose vehicle by the business trust is accorded a pass-through treatment and is taxable directly in the hands of the unit holders. The business trust is liable to deduct TDS on this interest income at the rate of 10% in the case of a resident unit holder and 5% in the case of Non-resident unit holders. Example Mr. Saurabh has to include the income of Rs.30,000 distributed by the business trust on 25/10/2017 as an interest income in his Income Tax Return.

- Rental Income: The rental income referred to in Section 10(23FCA) is taxable income in the hands of the unit holders. Any income of a business trust, being a real estate investment trust, by way of renting or leasing or letting out any real estate asset owned directly by such business trust is exempt in the hands of the business trust. This income is chargeable to tax in the hands of the unit holders as rental income. The REIT is liable to deduct TDS on such distributed income at the rate of 10% for resident unit holders and at the rates in force for non-resident unit holders. Example Mr. Saurabh has to show the income of Rs.25,000 distributed on 16/11/2017 by the business trust as rental income in his Income Tax Return.

- Dividend Income: Earlier, the dividend component of the income distributed by the business trust is exempt in the hands of the unit holder. The business trust was also provided an exemption in respect of such income. However, with effect from April 1, 2020, there has been an overhaul of India’s dividend tax regime. Until now Indian companies were required to pay DDT and shareholders (except non-corporate residents) were exempt. Going forward, the tax incidence will shift from the company to the shareholders.

- Any Other Income: Any distributed income, referred to in section 115UA, received by a unit holder from the business trust is exempt in the hands of the unit holder as per Section 10(23FD). Example The income of Rs.20,000 received on 25/10/2017 and Rs.23,000 received on 16/11/2017 is exempt in the hands of Mr. Saurabh.

Tax on Income on Sale of Units

The profit from the sale of the units of the business trust is chargeable to tax under the head capital gains. The tax treatment will differ for the Short-term capital gains and long-term Capital gains. The period of holding of units of the business trust to qualify as a long-term capital asset is more than 36 months.

- Short-Term Capital Gain: The short-term capital gains on which STT is paid is chargeable to tax at the rate of 15% as per section 111A. The deductions under Chapter VI-A are not allowed from such capital gains.

- Long-Term Capital Gain: The long-term capital gains on which STT is paid were exempt in the hands of the Unit holders under Section 10(38) till the A.Y 2018-19. Exemption for long-term capital gains arising from the transfer of units of business trust has been withdrawn by the Finance Act, 2018 with effect from Assessment Year 2019-20 and a new section 112A is introduced in the Income-tax Act. As per Section 112A, long-term capital gains arising from the transfer of a unit of a business trust shall be taxed at 10% (without giving the benefit of indexation). The tax on capital gains shall be levied in excess of Rs.1 lakh. The deductions under Chapter VI-A are not allowed from such capital gains.

2. IN THE HANDS OF THE BUSINESS TRUST:

REITs have been conferred as hybrid pass-through status for income tax purposes, meaning that the onward distribution of income by a REIT to its unit holders retains the same character as the underlying income stream received by the REIT. Interest income and rental income from property held directly by the trust, is not taxable in the hands of the REIT. However, any capital gains on the sale of assets/ shares of an SPV are taxable in the hands of the trust, depending on the period of holding whereas dividend income is not liable to tax. Further, any other income earned by a REIT shall be subject to tax at the maximum marginal rate. Business trust is compulsorily required to file return as per section 139(4E)

STATEMENT UNDER SUB-SECTION (4) OF SECTION 115UA:

(1) The statement of income distributed by a business trust to its unit holder shall be furnished to the Principal Commissioner or the Commissioner of Income-tax within whose jurisdiction the principal office of the business trust is situated, by the 30th November of the financial year following the previous year during which such income is distributed;

Provided that the statement of income distributed shall also be furnished to the unit holder by the 30th June of the financial year following the previous year during which the income is distributed.

(2) The statement of income distributed shall be furnished under sub-section (4) of section 115UA by the business trust to –

- the Principal Commissioner or the Commissioner of Income tax referred to in sub-rule (1), in Form No. 64A, duly verified by an accountant in the manner indicated therein and shall be furnished electronically under digital signature;

- the unit holder in Form No. 64B, duly verified by the person distributing the income on behalf of the business trust in the manner indicated therein.

FORM 64A

This form will comprise of the statement of income paid or credited by a venture capital company under section 115U of the Income Tax Act 1961. Any individual who is responsible of making payment of the income distributed on behalf of a business trust to a unit holder is required to furnish a statement to the authority within the prescribed time. This form can be submitted at the post offices and banks designated for this purpose. Form 64A can be found online on the official Income Tax filing website and can be downloaded from Forms download section or Directly download Form 64A. The form contains several details which need to be filled out before submission. It is important to fill out the correct details before submitting the form. Copy of certificate of registration under SEBI, copy of trust deed registered under the provisions of the registration act, 1908, Audited accounts including balance sheet, annual report and certifies copies of income shall be enclosed with the form 64A at the time of submission.

FORM 64B

The person distributing the income on behalf of the business trust is required to furnish the statement of income distributed to the unitholder in Form No. 64B by the 30th June.

check backlinks for free

Some truly nice stuff on this site, I like it.