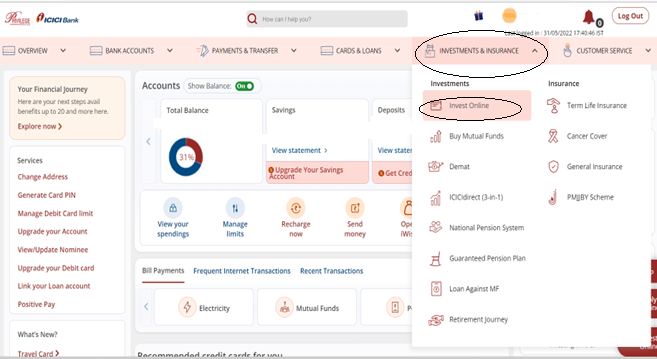

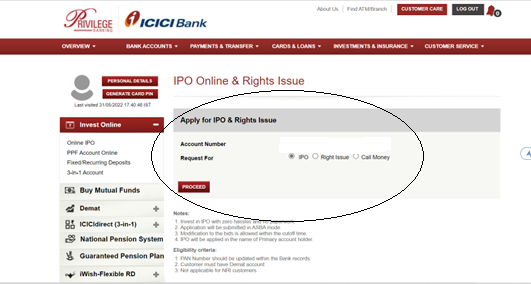

PROCESS FOR APPLYING IN AN IPO THROUGH ICICI BANK

Step 1: Login to your Net Banking Account.

Step 2: Click on ‘Invest Online’ under the Investments & Insurance tab.

Step 3: Click on ‘Invest Now’ in the Online IPO, Right Issues & Call Money column.

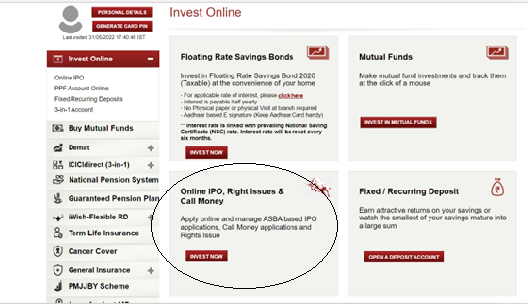

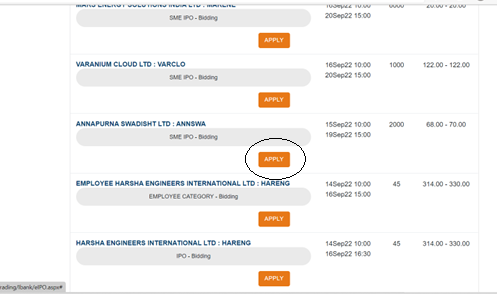

Step 4: You would get all the open IPOs for application. Click on ‘Apply’ button to choose the IPO.

Step 5: Fill in the bank details as required and proceed for the further application.

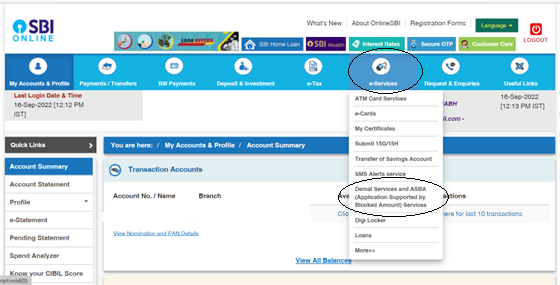

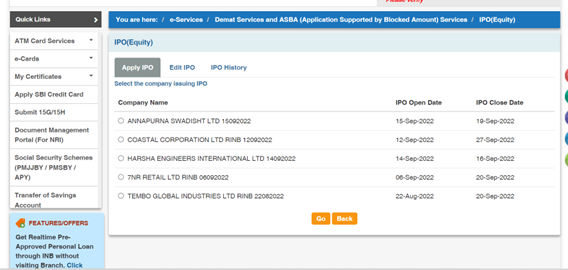

PROCESS FOR APPLYING IN AN IPO THROUGH SBI BANK

Step 1: Login to the Net Banking of SBI through the login credentials along with generating High Security Password sent on the respective mobile number.

Step 2: Click on ‘Demat Services and ASBA’ tab under “e-Services”.

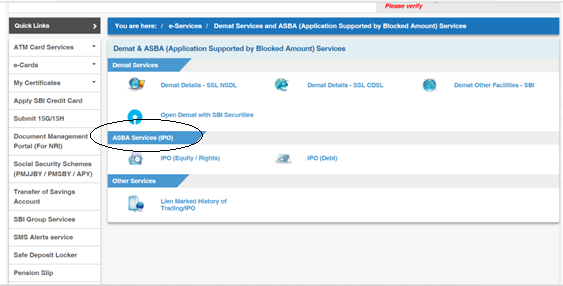

Step 3: Under ASBA Services, click on “IPO”.

Step 4: List of available IPOs will appear. You can select any IPO as per your choice.

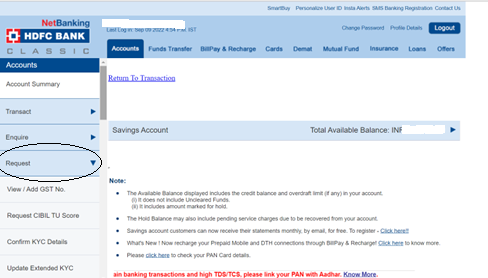

PROCESS FOR APPLYING IN AN IPO THROUGH HDFC BANK

Step 1: Login to HDFC Net Banking and click on ‘Request’ Tab on the left side.

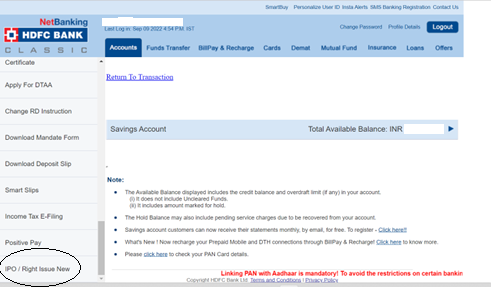

Step 2: Select ‘IPO/Right Issue New’ under Request tab.

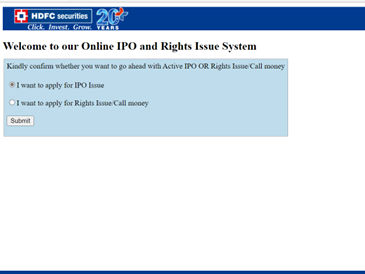

Step 3: Select the option for IPO Issue and choose the IPO you wish to apply for.

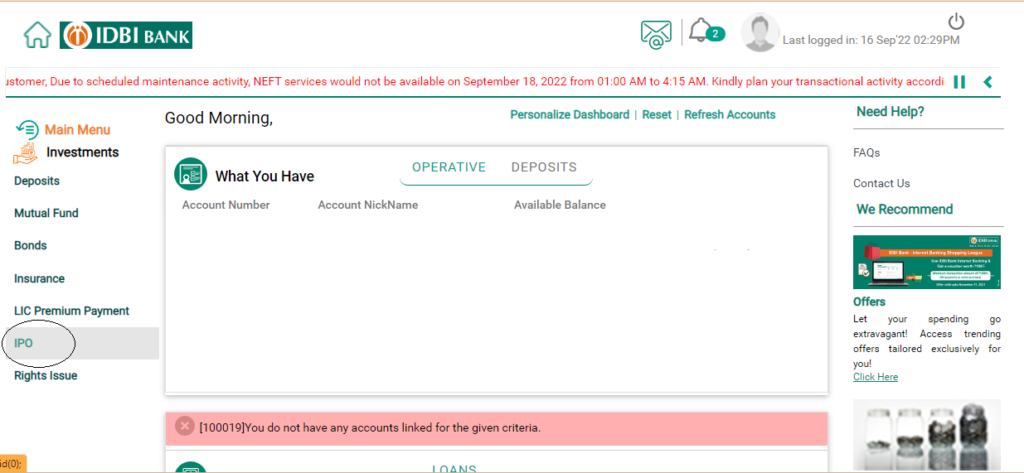

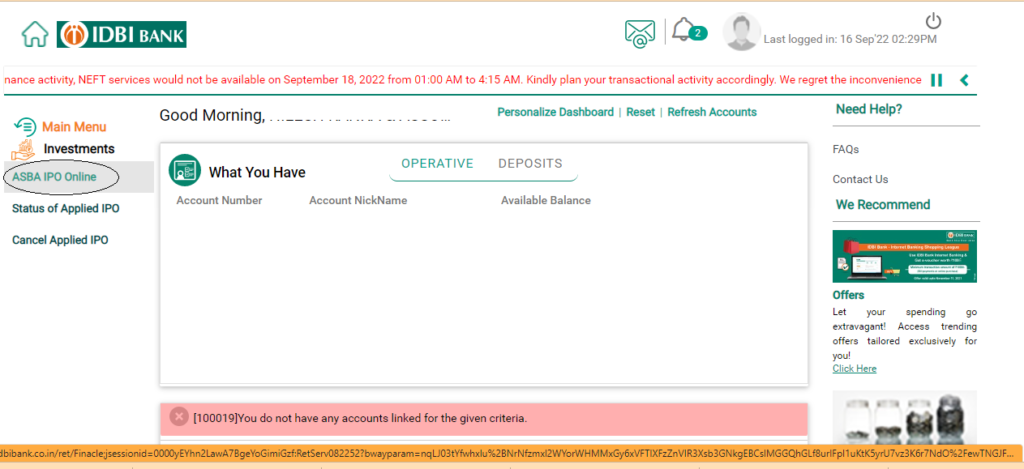

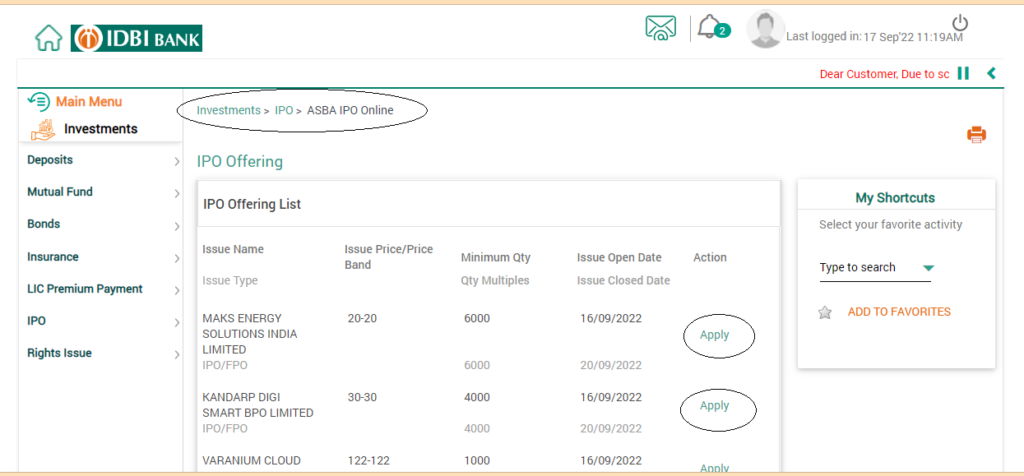

PROCESS FOR APPLYING IN AN IPO THROUGH IDBI BANK

Step 1: Login to Net Banking of IDBI Bank.

Step 2: Click on “IPO” on the left side under the Investments tab.

Step 3: Now, click on “ASBA IPO Online”.

Step 4: You will find the list of IPOs which are open on that date. Select the IPO of your choice and fill out the application providing the details of the quantity and amount that you want to invest.

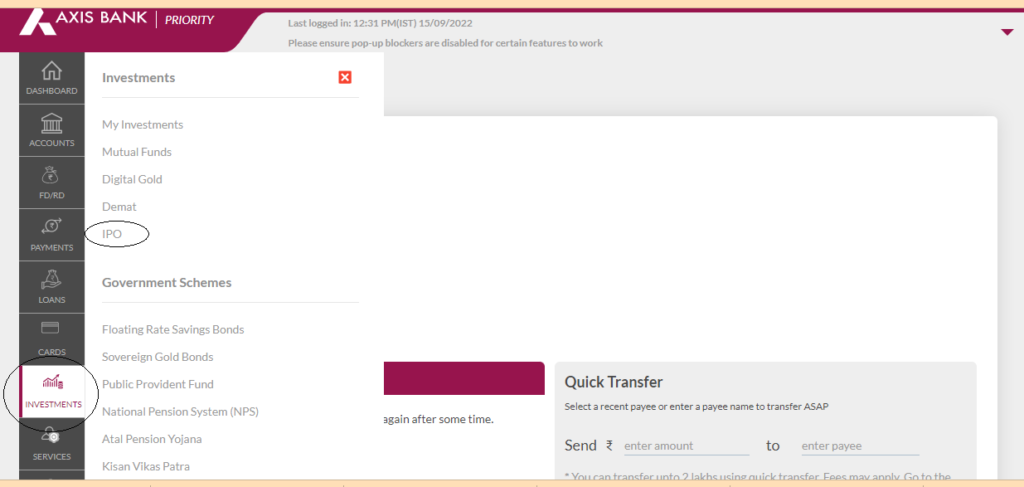

PROCESS FOR APPLYING IN AN IPO THROUGH AXIS BANK

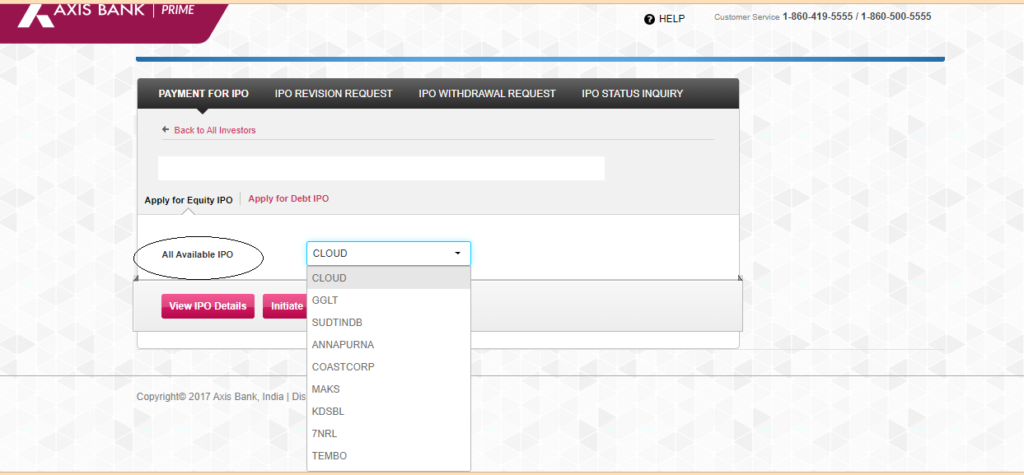

Step 1: Login to Net Banking of Axis Bank. Go to Investments>IPO.

Step 2: Go to “Apply for Equity IPO” and you will get all the available options for the IPO. Choose any IPO according to your choice and fill the required details as requested in the application form.

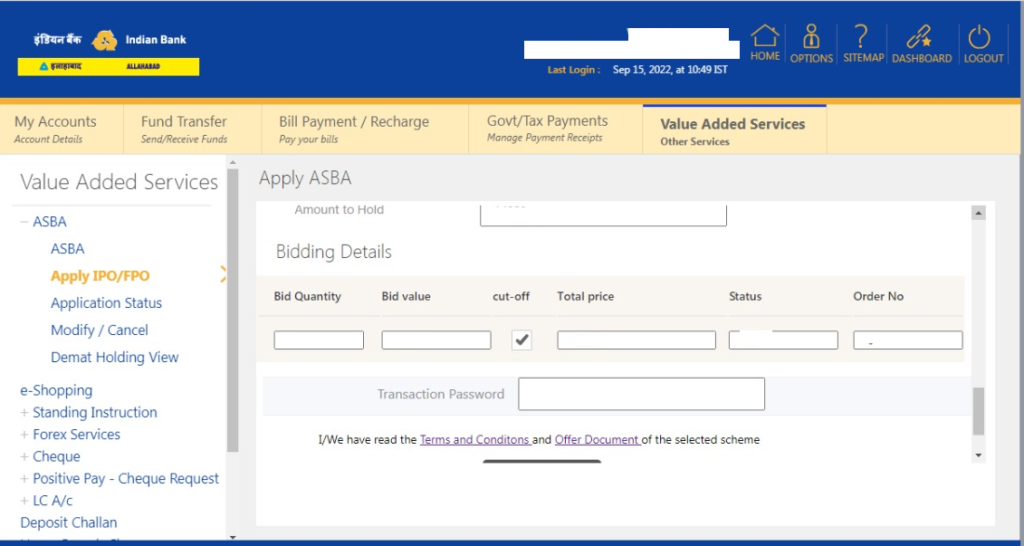

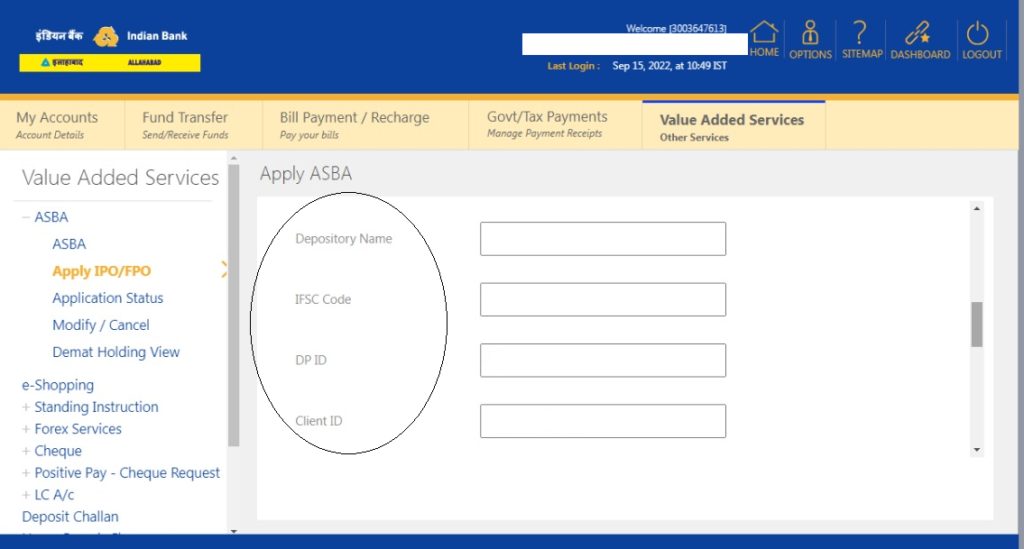

PROCESS FOR APPLYING IN AN IPO THROUGH INDIAN BANK

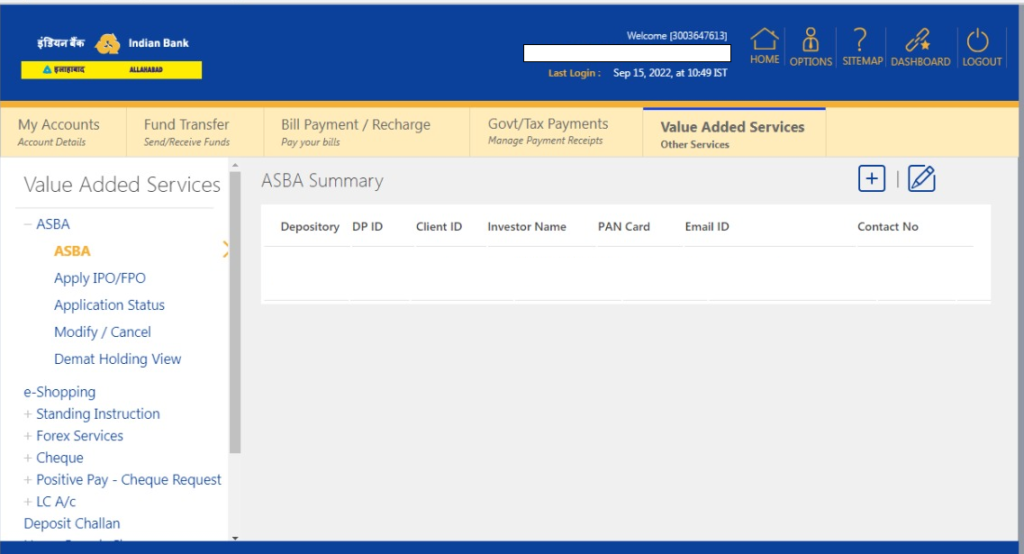

Step 1: Login to Net banking of Indian Bank. Click on ‘ASBA’ under “Value Added Services” tab.

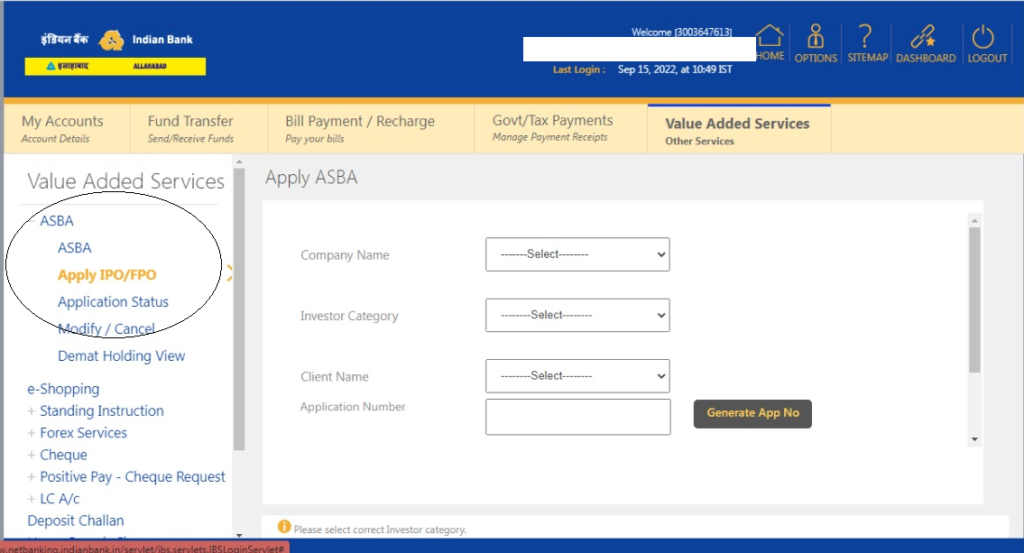

Step 2: Click on “Apply IPO/FPO”. Fill in the details and Generate Application Number for the same.

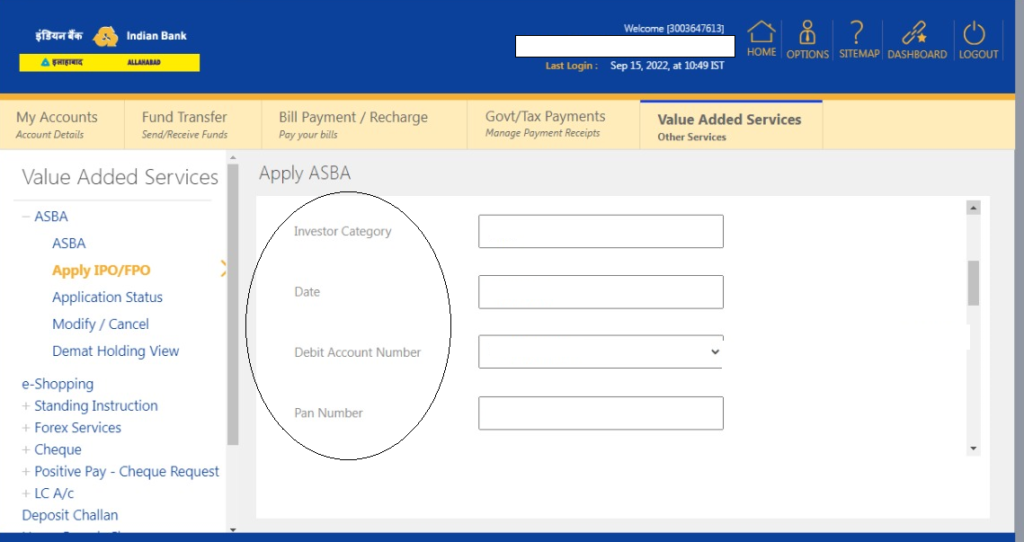

Step 3: Fill in the required details for application.

Step 4: Enter the details regarding the Quantity and Value for the Bid and complete the process by entering the Transaction Password.